Revolut

Sharesight allows you to bulk import your historical buy and sell trades directly from Revolut.

Import historical trades

You will require a CSV file export out of Revolut to import your trading history into Sharesight. You can do this by following the below steps.

-

Open your Revolut app

-

Select Stocks tab at the top

-

Click on the three dots for More

-

Select Statements > Account statement

-

Select Excel

-

Set Start and End date to cover all historical trades

-

Select Get statement

-

Download statement to your phone

Once your file is downloaded, you can import it to Sharesight using the steps below.

1 – Login to Sharesight.

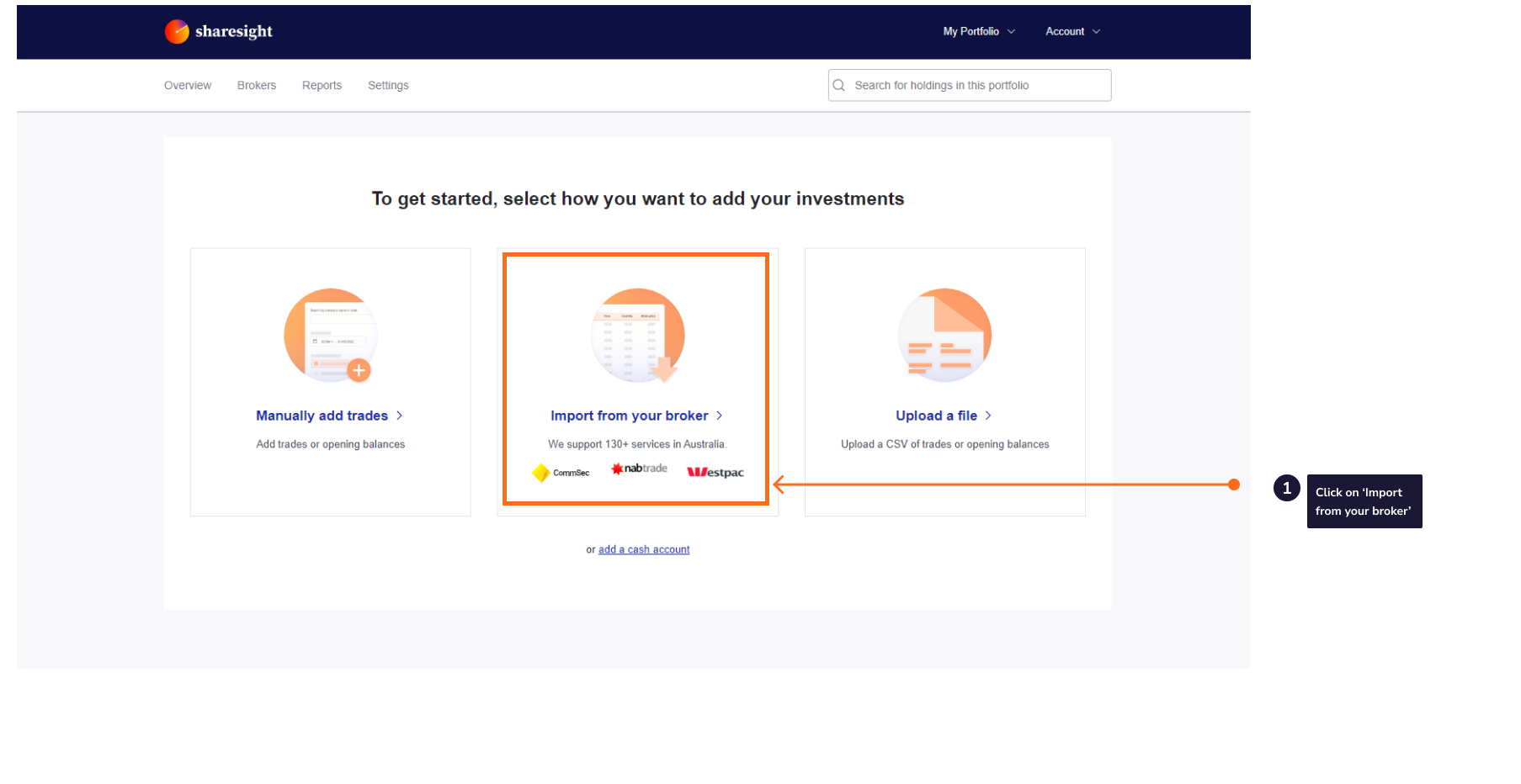

2 - On the ‘Let's get you started with Sharesight’ page, select the ‘Import from a Broker’ tile.

3 - Click on the ‘Revolut’ tile on the ‘Import from a Broker’ page.

4 – Click the 'Upload a file' button.

5 - Select the CSV of trades you wish to import.

6 - Click import.

Note: If you have changed brokers and transferred the holdings to Revolut these trades will not be imported into Sharesight, and will need to be added manually.

7 – The ‘Trades to import into Portfolio’ page will show an itemised list of all trades imported from your Revolut trading account. Verify and edit the trade data as required. If trades appear in red, this means that Sharesight can’t upload the trade or the trade will cause errors in your portfolio.

8 – Once you have verified the trade data, click ‘Save all transactions’.

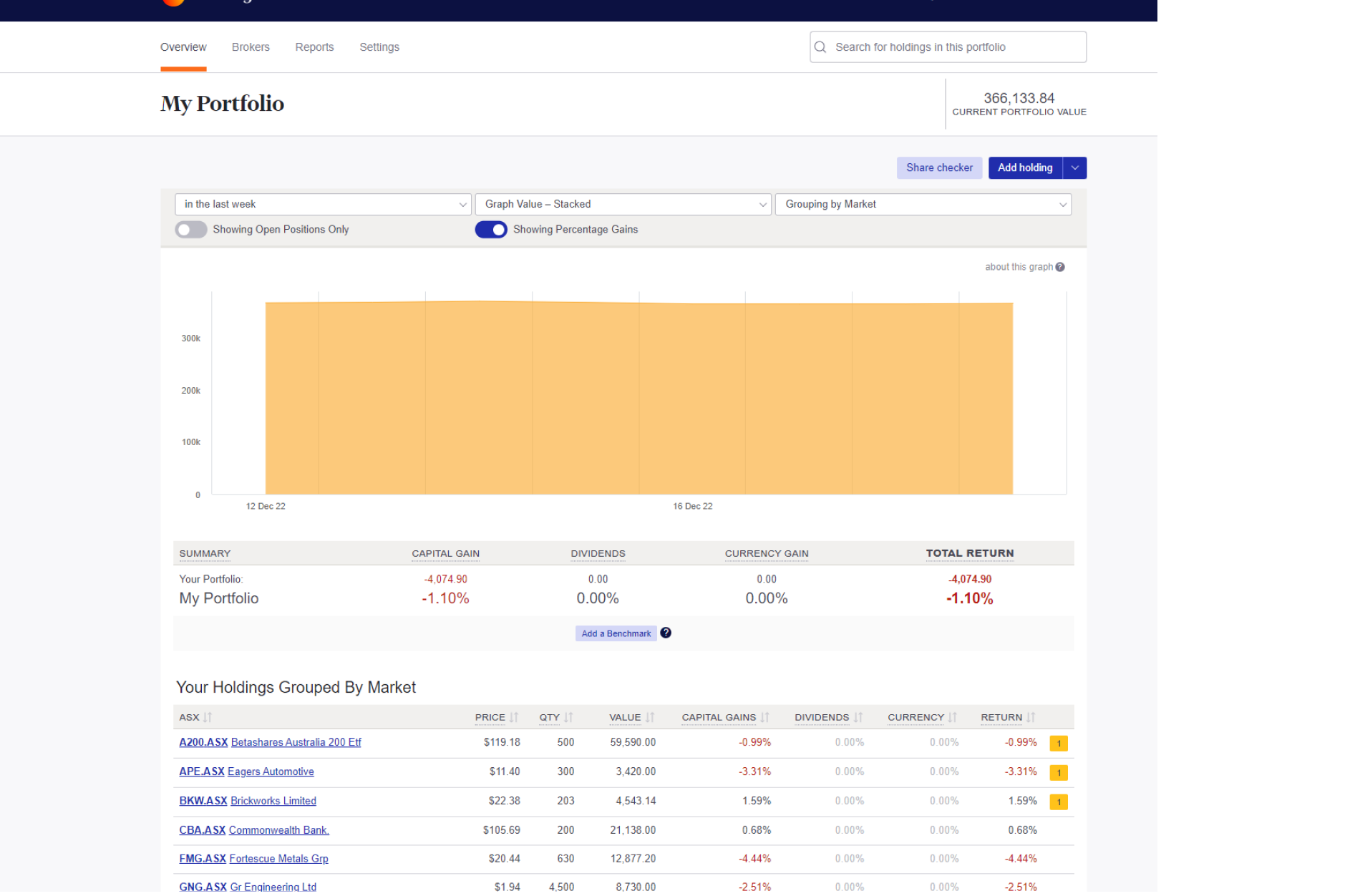

9 - Once the trades are saved, your Sharesight portfolio will be populated and the Portfolio Overview Page will load.

Your holdings will be calculated with Sharesight’s performance calculation methodology, which is a money-weighted return methodology, meaning the performance figures take account of the size and timing of cash flows.

Sharesight will automatically create dividends and corporate actions for the holdings you have imported.

Now that you have populated your portfolio we recommend you:

1 - Review the trades imported:

a – Handle any negative holdings - Holdings with less buy trades than sell trades (occurs when you have transferred stocks from another broker).

b - Check fractional share trades for rounding differences.

c - Exchange rates are generated by Sharesight using the end of day exchange rate. These can be edited within the trade.

d - Handle any non automated corporate actions such as mergers etc.

2 - Verify and confirm automatically generated data (dividends and corporate actions).

3 - Set up the Trade Confirmation Emails feature to automatically import future trades.

4 - Share access to your portfolio with your accountant.