Latest posts

What is the FIRE movement?

A growing number of people are embracing the FIRE movement, a financial strategy and lifestyle that is also known as Financial Independence, Retire Early.

Do dividends get taxed?

Investing in dividend-paying stocks is one way to earn additional income, however Australian investors should be aware of the potential tax implications.

ESS vs. ESOP: What’s the difference?

This article explores the differences between an ESS and an ESOP, and the key legal considerations when implementing one of these schemes.

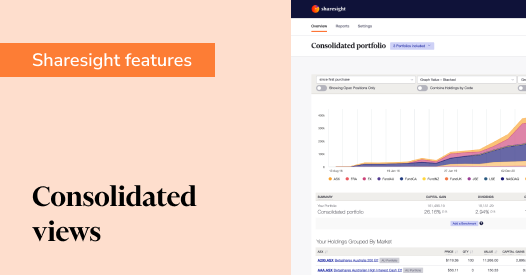

4 reasons to use consolidated views in Sharesight

By using consolidated views, you can see all of your portfolios in one view, making it easy to see your overall performance and identify areas for improvement.

Crypto tax: What Australian investors need to know

Cryptocurrency is an increasingly popular asset for investors, but with this comes the need to understand what crypto trading means for your tax obligations.

Calculating taxable gains on share trading in New Zealand

While no general capital gains tax applies in New Zealand, a tax on gains made may apply to NZ investors who trade in equity or foreign debt investments.

What is leveraged investment?

Before investing with leverage, investors should consider their investment goals, risk tolerance, market conditions and liquidity. Keep reading to learn more.

What are the new Employee Share Option Plan disclosure exemptions?

Since October 2022, new Employee Share Option Plan rules are in place, making it easier for startups to manage their ESOPs.

How to teach your kids about investing

This blog discusses simple ways to explain investing to your kids, plus hands-on strategies to give your kids safe and practical investing experience.

What does liquidity mean in investment?

In investment terms, liquidity refers to how quickly an investor can get their money back should they require it. To learn more, keep reading.

What is debt recycling and how does it work?

Debt recycling is a process that can potentially make you more money by turning non-deductible debt into deductible debt. How does it work? Keep reading.

Types of fixed income funds

Fixed income funds are one option for investors looking for a steady income stream with less risk than individual stocks. Keep reading to learn more.