4 ways to prepare your investment portfolio for retirement

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

Retirement is not always front-of-mind for younger investors who may be many years away from this transition. But planning for retirement is a theme you should revisit regularly, particularly in constructing and realigning investment portfolios that factor in goals beyond your working life. And while you should speak to a financial adviser about a specific retirement plan tailored to your circumstances, this piece offers an overview of some strategies and theories you may wish to consider.

How much should I invest for retirement?

Retirement planning is a multistep process that will evolve over time as your priorities change. However, there are several retirement savings benchmarks based on age and salary that can help you set attainable targets and track your progress towards them. Most of these acknowledge that there are times when paying off a student loan or saving money to buy a home will be more of a priority, but stress the importance of making steady progress towards a retirement nest egg. As a general guide, some experts suggest putting aside 15% of your income each year for retirement.

One way to plan for retirement is to consider your circumstances relative to savings benchmarks that show the ideal levels of savings at different ages versus your income. For example, having one to one-and-a-half times your income saved for retirement by age 35 is largely considered a reasonable target. According to this logic, by age 50 you would want to be closer to four or five times your annual gross income saved.

The 10/30/60 rule is another interesting rule of thumb, as it asserts that your retirement income should come from three sources: 10% from money you saved during your working years, 30% from investment returns before you retire and 60% from investment returns during your retirement. This makes the important point that you will likely need to continue investing in retirement.

Factors to consider when planning your retirement

Whether you’re investing in a pension fund such as an SMSF or ISA, or you plan to use your investment portfolio to generate supplemental income in retirement, there are four important factors to consider in your retirement planning.

Time horizon

All the advice is to start your retirement planning early for the simple reason that younger investors can take far greater risks with their investment portfolios. Share markets may experience short-term volatility but over the long term they are considered a key pillar underpinning an effective retirement strategy. Other securities, such as bonds, also play a role but it is the ability of share markets to outpace inflation that is key to maintaining purchasing power in retirement.

Generally, as you approach retirement, your portfolio should be more focused on income and the preservation of capital, which won’t give you the same return as shares but will be less volatile and provide income that you can use to live off. Therefore, a multistage retirement plan must change as you age to determine the optimal allocation strategy, and this will mean rebalancing your portfolio as the time horizon changes.

Risk tolerance

The 60/40 portfolio has long been the standard-bearer for investors with a moderate risk tolerance. The theory is that by investing 60% in shares and 40% in bonds you have a solid initial starting point for your portfolio. And while this may be considered a diversified portfolio, the exact proportion of the mix is often adjusted based on your time horizon, risk tolerance and financial goals.

Generally, it has worked in the past because growth assets, like shares, tend to sell off in an economic slowdown while fixed income assets like bonds typically appreciate. However, share and bond performance has often been coupled together in recent years, proving that the 60/40 portfolio is a good starting point but not always a proxy for a diversified, balanced portfolio.

Cost of living

Your average life expectancy is a good starting point when determining your investment time horizon, but relying on average life expectancies can underestimate how long you may live in an age of rapid medical advancements. Another great unknown is the extent to which cost-of-living pressures may eat into your savings, especially when these expenses are unforeseen. After all, who could have foreseen the COVID-19 pandemic and the combination of a health crisis with devastating economic consequences?

This means asking yourself some tough questions: Do I have realistic expectations about my post-retirement spending habits? How am I placed if unforeseen medical expenses occur? Can I afford to spend my first few years of retirement splurging on travel or other bucket-list goals? Do I have an option to work part-time in retirement to optimise my savings?

Realistic retirement rate of return

Once you have a better idea of your time horizon, risk tolerance and plan to counter cost-of-living pressures, you can start to consider how your investment portfolio may be assessed by your country's age pension rules and tax regime.

Depending on the type of retirement account that you hold, investment returns are typically taxed. Therefore, the actual rate of return must be calculated on an after-tax basis and determining your tax status when you begin to withdraw funds is a crucial component of the retirement planning process. Likewise, countries that pay out an age pension have a variety of ways of assessing income and it is wise pre-retirement to consider how best to structure your assets for the maximum pay-out.

Key takeaways

Overall, it’s advised that you work with a financial professional to determine the pathway to retirement that best fits your needs and goals. It’s important to understand that this pathway will be very much determined by your age, financial position and how far you are from retirement. For most investors, this will require the creation of a multi-stage retirement plan that changes as you age. In practical terms, this means you (or your financial adviser) will need to regularly re-evaluate your asset allocation (as well as your asset allocation target) and rebalance your investment portfolio as needed.

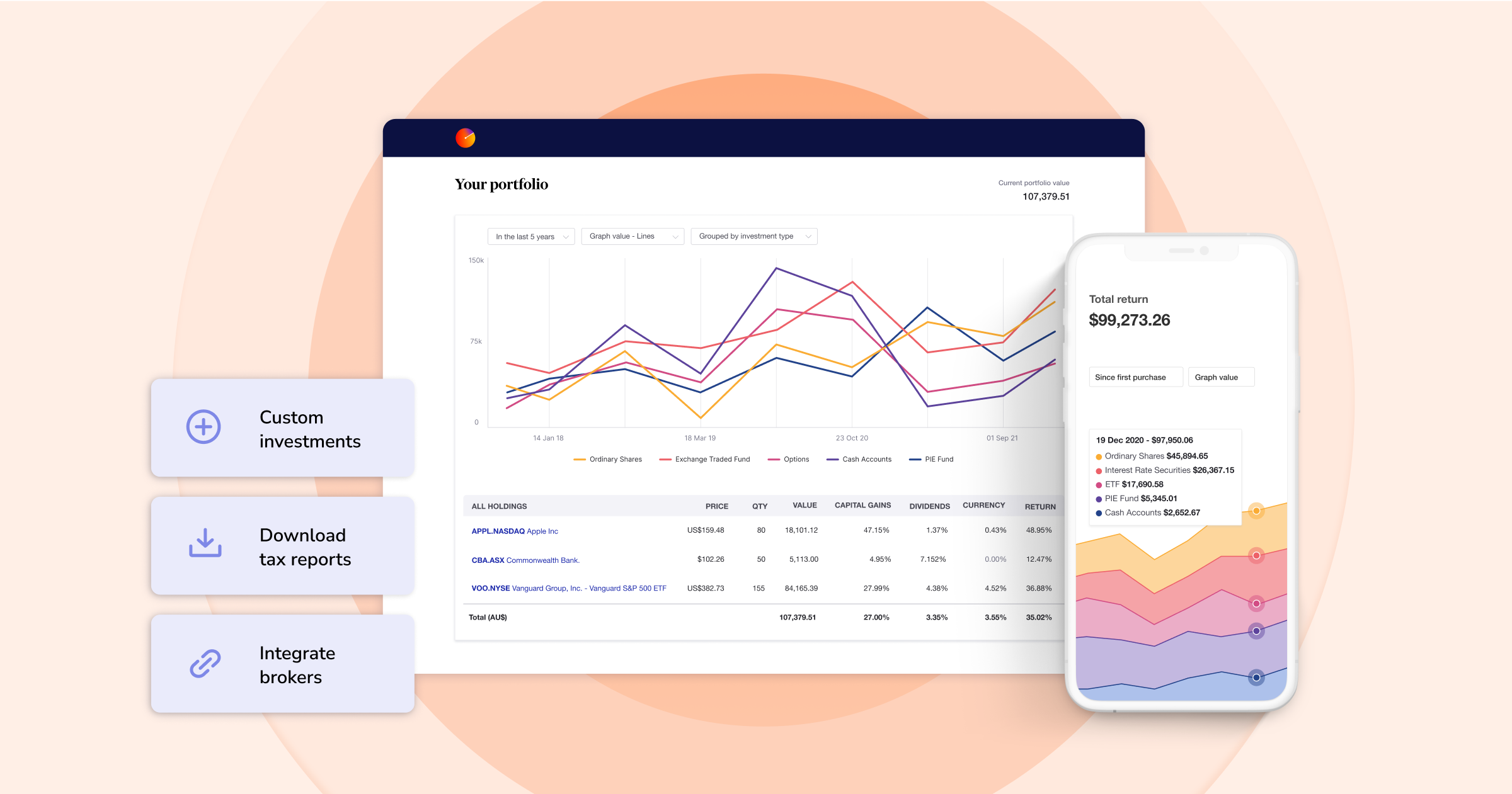

Be a prepared investor with Sharesight’s portfolio tracker

If you’re not already using Sharesight, what are you waiting for? Join hundreds of thousands of investors using Sharesight to track their portfolio and make better investment decisions. Sign up today so you can:

- Track all your investments in one place, including stocks in over 60 major global markets, mutual/managed funds, property, and even cryptocurrency

- Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation, exposure and future income (upcoming dividends)

- Easily share access to your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

How Sharesight helps advisors track net worth and simplify compliance

We talk to Ryan Jones, Partner, Accountant and Financial Advisor at Jones Louros, about how he uses Sharesight to manage his clients’ investment trusts.

Automatically track Swissquote trades with Sharesight

If you trade using Swiss broker Swissquote, you can automatically import your trading data to your Sharesight portfolio.

Dividends vs. share buybacks: Which is better for investors?

We take a look at dividends and share buybacks, discussing the pros and cons of each, the tax implications and which one is more beneficial for investors.