Latest posts

Track fractional shares with Sharesight

Today we’re pleased to announce that we’ve added fractional share support across those markets that permit trading in fractional quantities.

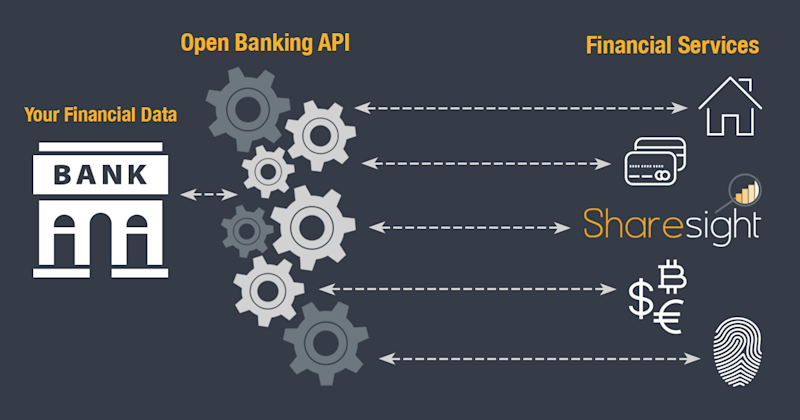

Open Banking changes in Australia

We welcome the recent Australian Government decision to create a regulated Open Banking system that will allow Australians to unlock their own financial data.

Sharesight is a Benzinga Global Fintech Awards Finalist

Sharesight has been named a finalist in the 2018 Benzinga Global Fintech Awards for Best Financial Advisor or Wealth Management Platform.

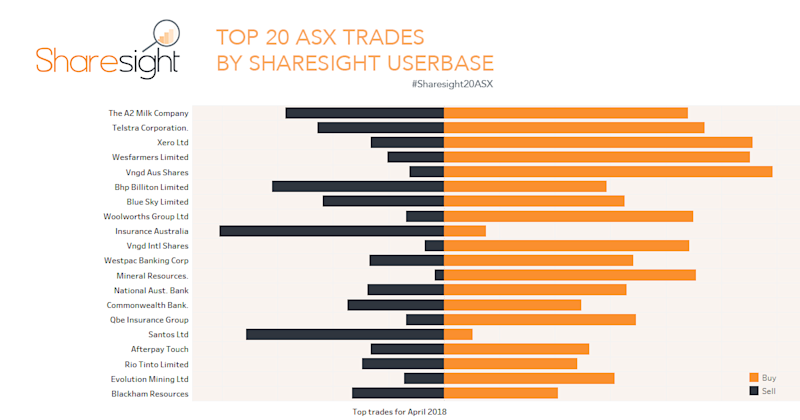

Sharesight20 April top 20 trades on ASX & NZX

Welcome to the April 2018 edition of the Sharesight20 monthly trading snapshot, where we look at the top 20 trades on both the ASX and NZX markets.

Q&A with new Sharesight partner Balance Impact

We asked CEO & founder Emily Martin to tell us about Balance Impact and how they’re using Sharesight to monitor their ethical investment portfolios.

Import foreign exchange transactions via CSV

You can now import historical foreign exchange (or FX) transactions (including cryptocurrencies) to your Sharesight account.

4 reasons to stop relying on your broker’s performance reports

When you login to your broker to check your portfolio performance, do you know what those numbers really mean, and more importantly, what’s missing?

Sharesight at the Fintech Business Awards 2018

With Sharesight nominated for Investment Innovator of the Year 2018 by Fintech Business, it was an honour to attend the awards gala in Sydney last week.

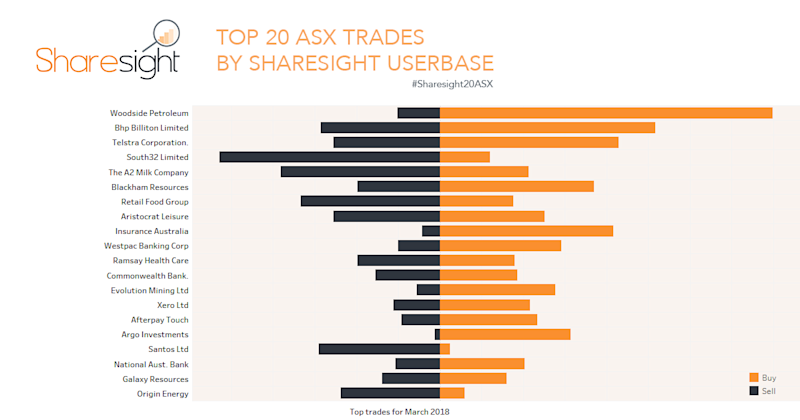

Sharesight20 March top 20 trades on ASX & NZX

Welcome to the March 2018 edition of the Sharesight20 monthly trading snapshot, where we look at the top 20 trades on both the ASX and NZX markets.

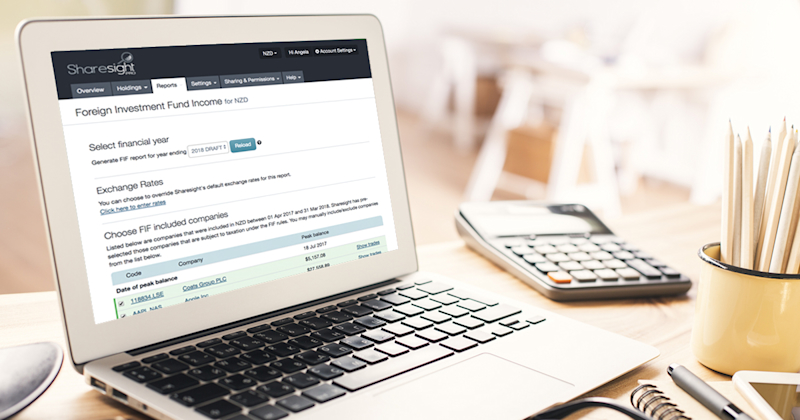

How to calculate your 2018 FIF income

Sharesight's comprehensive FIF Report automatically calculates your 2017-2018 FIF income, which you can use for your New Zealand IRD tax return.

Sharesight portfolio sharing now on all plans (even free!)

Given its popularity among investors on Sharesight premium plans, we have made portfolio sharing available to everyone -- including free Sharesight accounts.

3 ways Sharesight's professional plan simplifies NZ tax returns

Here are 3 ways you can get a head-start on preparing your clients’ tax returns with Sharesight Pro, before they even make an appointment to see you!