Sharesight users' top 20 SMSF trades of FY22/23

Welcome to our annual Australian financial year trading snapshot for SMSFs, where we look at Sharesight users’ 20 most traded SMSF stocks during the 2022/23 financial year. To find out the market-moving news behind some of these stocks, keep reading.

In this FY22/23 SMSF trading snapshot, buy trades were led by Macquarie Group (ASX: MQG), which saw its share price fluctuate throughout the financial year, with downside likely related to rising interest rates and investors’ concerns over the potential impact on lending. Despite this, the company continued to produce strong earnings results throughout FY22/23. At the same time, sell trades were led by Woodside Energy (ASX: WDS), which went from strength to strength throughout the financial year, at one point hitting an 8-year high in its share price due to soaring oil and gas prices. Sell trades were closely followed by BHP (ASX: BHP), which had a mixed financial year in terms of its quarterly earnings and in turn, its share price.

Overall, the top 20 SMSF trades were highly skewed towards ASX blue chip stocks, particularly those in the mining and banking sectors.

Woodside Energy (ASX: WDS)

-

July 2022: Woodside share price drops despite strong Q2 revenue

-

September 2022: Woodside signs deal to supply LNG to Europe

-

November 2022: Share price hits 8-year high amid soaring oil and gas prices

-

December 2022: Woodside reveals cash flow outlook; analysts concerned about future dividend payouts

-

January 2023: Woodside records highest-ever quarterly production

-

February 2023: Woodside profit hits record high due to BHP merger and soaring oil and gas prices

-

March 2023: Seeks shareholder approval for CEO bonus; pay rise for directors

-

April 2023: CEO assures shareholders that stalled Browse LNG project is still "very attractive"

-

May 2023: Share price rises as analysts declare Woodside will be largely unscathed by PRRT changes

-

June 2023: Woodside shareholders back AU$10 billion Mexican oil project despite activist warnings

BHP (ASX: BHP)

-

July 2022: Reports strong quarterly performance, but warns of volatile FY23

-

August 2022: OZ Minerals turns down BHP’s AU$8.3 billion takeover offer

-

September 2022: BHP share price down 14% in a month

-

October 2022: Relief for BHP as Chile lowers mining taxes

-

November 2022: BHP makes final offer of AU$9.6 billion for OZ Minerals

-

December 2022: BHP and OZ Minerals extend takeover deadline

-

January 2023: Share price rises on strong Q2 results

-

February 2023: Profit falls 32% amid low iron ore prices

-

March 2023: Share price falters amid concerns over super-profit tax

-

April 2023: BHP’s latest quarterly earnings fall slightly short of expectations

-

May 2023: BHP shares hit 6-month low amid plummeting iron ore prices

-

June 2023: Share price drops following news of carbon reduction plans

Macquarie Group (ASX: MQG)

-

July 2022: Macquarie reports strong quarterly earnings, but warns of ‘softening’ ahead

-

September 2022: Share price drops 10% following rejected takeover bid for UK waste business

-

October 2022: Macquarie share price hits 52-week low

-

February 2023: Could hit record profit due to gains from energy volatility

-

March 2023: Announces investment in US fibre business Pavlov Media

-

May 2023: Macquarie announces record AU$5.2 billion profit

Westpac (ASX: WBC)

-

July 2022: Plans to sell off investment platform for AU$1 billion

-

October 2022: Reveals AU$1.3 billion hit to half-year earnings

-

December 2022: Forced to pay AU$29 million in super class action

-

January 2023: Westpac’s BT Panorama sale stalled due to dip in valuation

-

February 2023: Westpac share price drops following mixed quarterly results

-

March 2023: Share price down 6% in March

-

May 2023: Westpac shares jump following announcement of AU$4 billion half-yearly profit

Pilbara Minerals (ASX: PLS)

-

August 2022: Posts inaugural full year net profit of AU$562 million

-

September 2022: Pilbara share price reaches record high following lithium auction

-

October 2022: Pilbara reveals strong quarterly earnings

-

November 2022: Pilbara shares rise on announcement of Calix deal

-

December 2022: Sells AU$120 million-worth of spodumene in pre-Christmas lithium auction

-

February 2023: Share price rises following strong earnings results; maiden dividend announcement

-

March 2023: Pilbara share price surges as lithium investor sentiment soars

-

April 2023: Share price drops amid falling lithium prices

-

May 2023: Pilbara shares rise on news of Allkem mega-merger with Livent

-

June 2023: Pilbara searches for partner to build AU$1 billion processing plant

CSL (ASX: CSL)

-

August 2022: Approved for AU$16.7 million acquisition of Vifor Pharma; share price climbs

-

November 2022: CSL approved to bring world-first hemophilia gene therapy to market

-

December 2022: CSL COO Paul McKenzie to take over as CEO from March 2023

-

June 2023: Share price drops 8% following revised profit forecast

ANZ (ASX: ANZ)

-

July 2022: ANZ announces AU$5 billion deal to acquire Suncorp

-

August 2022: Completes AU$3.5 billion capital raise to fund Suncorp acquisition

-

December 2022: ANZ shareholders vote to establish new holding company, separating banking and non-banking businesses

-

February 2023: Share price falls following quarterly results

-

May 2023: Releases record-breaking half-year results

-

June 2023: New report could convince ACCC to block ANZ-Suncorp deal

Commonwealth Bank (ASX: CBA)

-

August 2022: CBA beats expectations in FY22 results

-

February 2023: Interest rate rises propel CBA profit to AU$5.15 billion

-

March 2023: CBA shares slide as sudden US bank collapse spooks Australian investors

-

June 2023: Fined record AU$3.55 million for breaching spam laws

NAB (ASX: NAB)

-

August 2022: NAB delivers Q3 profit in line with expectations; revises FY22 cost growth guidance

-

November 2022: NAB delivers strong earnings growth in FY22

-

May 2023: Share price drops 8% on expected EPS downgrade

Mineral Resources (ASX: MIN)

-

August 2022: Mineral resources share price skyrockets 40% in a month following strong quarterly earnings report

-

February 2023: Mineral Resources reports earnings growth of 503% but misses analysts’ expectations

-

April 2023: Share price plummets 9% despite record quarterly lithium shipments

-

June 2023: Finalises acquisition of Norwest Energy

Track your SMSF investments with Sharesight

Get access to insights like this by tracking your SMSF investments along with the rest of your portfolio using Sharesight. Built for the needs of SMSF trustees like you, with Sharesight you can:

-

Organise holdings according to your documented SMSF asset allocation and investment strategy, providing valuable insights throughout the year

-

Easily share SMSF portfolios with accountants or financial professionals to make admin and tax compliance a breeze

-

Track SMSF investment performance with prices, dividends and currency fluctuations updated automatically

-

Run powerful tax reports built for Australian investors, including capital gains tax, unrealised capital gains, and taxable income (dividend income)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

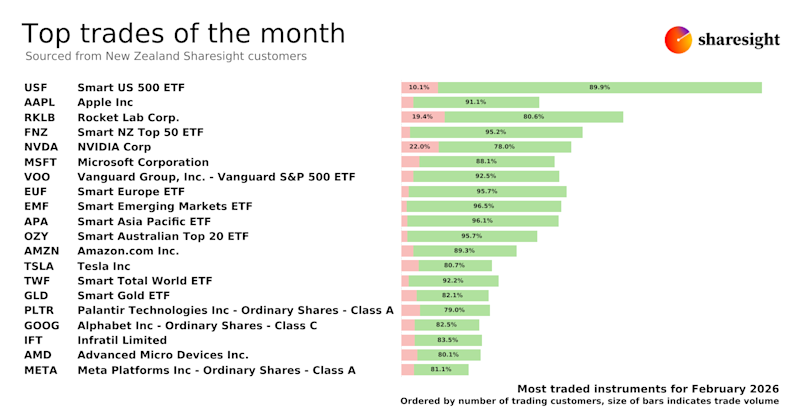

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

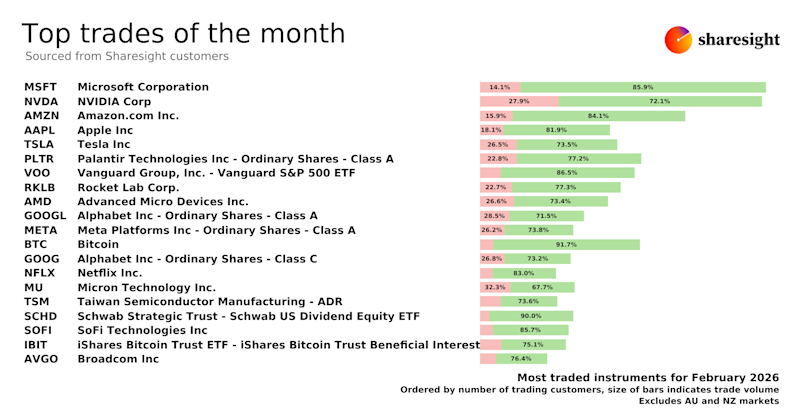

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

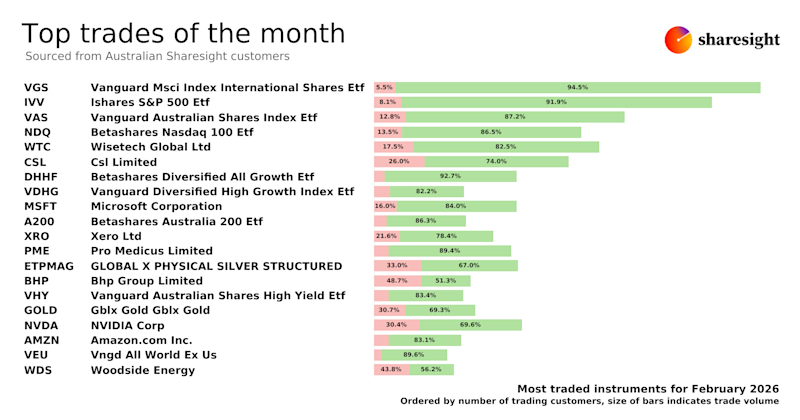

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.