Sharesight users' top 20 SMSF trades of FY20/21

Welcome to our annual Australian financial year trading snapshot for SMSFs, where we look at Sharesight users’ 20 most traded SMSF stocks during the 2020/21 financial year. To find out the market-moving news behind some of these stocks, keep reading.

In this snapshot, buy trades were led by CSL (ASX: CSL), which saw its share price suffer throughout FY20/21 due to a combination of plasma shortages and issues surrounding the development of a COVID-19 vaccine with UQ. At the same time, sell trades were led by BHP (ASX: BHP), which was the subject of controversy throughout FY20/21 due to its plans to destroy Aborignal heritage sites in the Pilbara region of WA. Other popular SMSF trades included Fortescue Metals (ASX: FMG) and Woodside Petroleum (ASX: WPL).

CSL (ASX: CSL)

-

July 2020: Initiates US Coronavirus vaccine trial

-

October 2020: Finalises deal to produce 51 million doses of potential COVID-19 vaccine

-

November 2020: CSL to build AU$800m vaccine manufacturing facility

-

December 2020: Coronavirus vaccine by UQ and CSL abandoned due to false-positive HIV response

-

January 2021: CSL trading around its COVID lows

-

February 2021: CSL certain it could produce vaccine to tackle COVID-19 variants

-

March 2021: Share price up following AstraZeneca vaccine approval

-

April 2021: CSL to make 50 million AstraZeneca vaccine doses despite public pushback

-

June 2021: Share price lower despite plans to buy rights for haemophilia treatment

Fortescue Metals (ASX: FMG)

-

August 2020: Fortescue posts record profit; increases dividend to shareholders

-

October 2020: Accused of withholding AU$1.9m in royalties from Aboriginal people

-

January 2021: Fortescue reports AU$1.2b December profit on back of high iron ore prices; raises dividend expectations

-

February 2021: Senior executives resign over cost blowout of AU$2.6b Iron Bridge project

-

March 2021: Fortescue declares goal to go carbon neutral by 2030

-

April 2021: Achieves 1.5b tonnes of iron ore exports from Pilbara operations

-

May 2021: Iron Bridge project now faces US$3.5b cost blowout

Woodside Petroleum (ASX: WPL)

-

July 2020: Woodside puts projects on hold due to struggling oil market

-

September 2020: Trouble for Woodside projects as LNG prices slashed

-

October 2020: Woodside reports 43% drop in Q3 revenue due to COVID-induced oil price cuts; plans to cut 300 direct staff jobs

-

December 2020: Woodside CEO announces 2021 retirement

-

January 2021: Reports almost 35% drop in Q4 revenue YoY; cites weak oil and gas prices

-

April 2021: Appoints Meg O’Neill as acting CEO; says CEO search is "well-progressed"

-

May 2021: Plans to sell 50% stake in Kitimat LNG project

BHP (ASX: BHP)

-

July 2020: BHP reports record iron ore shipments while oil and gas suffers due to COVID

-

August 2020: Plans to reshape portfolio by offloading coal, oil and gas assets

-

September 2020: BHP tells inquiry it was permitted to destroy Aboriginal heritage sites in Pilbara

-

October 2020: Puts halt to AU$3.5b expansion plan for Olympic Dam; makes AU$700m acquisition in Gulf of Mexico

-

December 2020: BHP shareholders demand stop to mining that destroys Aboriginal heritage sites

-

January 2021: Slashes value of its thermal coal assets by up to AU$1.6b

-

February 2021: BHP pays record dividend amid high iron ore prices and positive economic outlook

-

May 2021: BHP scores AU$17m Elliot copper project deal

Telstra (ASX: TLS)

-

July 2020: Share price reaches turning point following COVID-19 slump

-

August 2020: FY20 profits see 14% drop

-

September 2020: Share price hits 52-week low following weak FY21 guidance

-

October 2020: Share price drops 23%; hits multi-year low

-

November 2020: Telstra announces its biggest restructure since privatisation, splitting into three legal entities

-

February 2021: Share price reaches 6-month high; dividend price maintained

-

May 2021: Telstra fined AU$50 million for mistreatment of Indigenous customers

Zip Co (ASX: Z1P)

-

July 2020: Market cap rises by more than AU$1.4 billion after Quadpay acquisition announcement

-

August 2020: Zip Co has a record-breaking Q4

-

September 2020: Zip Co completes QuadPay acquisition

-

October 2020: Zip Co has almost doubled its transaction volumes and revenue compared to last year

-

November 2020: Shares rise following announcement of strong FY21 growth figures

-

December 2020: Zip Co raises AU$120 million for overseas expansion

-

January 2021: Announces strong quarterly earnings; 88% revenue growth YoY

-

February 2021: Seeks US investors; potential US exchange listing

-

March 2021: Share price drops as Zip Co reports mounting losses

-

April 2021: Raises AU$400m for US growth and further global expansion

-

May 2021: Zip Co expands global presence with buyouts in EU and UAE

Afterpay (ASX: APT)

-

July 2020: Records highest ever quarterly earnings as COVID shutdown encourages online shopping; announces AU$800 million global expansion plans

-

August 2020: Afterpay lands AU$80 million European expansion deal

-

September 2020: Online sales help boost Afterpay share price by 800%

-

October 2020: Afterpay enters partnership with Westpac, giving users access to banking services

-

November 2020: Moves to co-CEO model to manage international growth

-

December 2020: RBA rules merchants using BNPL cannot pass fees onto customers

-

January 2021: Share price has grown 250% YoY

-

March 2021: Launches Clearpay in European payments market

-

April 2021: Afterpay seeks Nasdaq listing; could delist from ASX

-

May 2021: Signs that Afterpay may enter SME lending space

-

June 2021: Share price could come under pressure as PayPal expands Australian payment offerings

Commonwealth Bank (ASX: CBA)

-

August 2020: CBA dividend payout better than expected despite profit loss

-

September 2020: Announces new no-interest credit card to compete with BNPL

-

November 2020: CBA shares skyrocket throughout November as investors turn to value stocks

-

February 2021: Half-year profit drops by 21% YoY due to recession; low interest rates

-

April 2021: ASIC sues CBA over misleading monthly fees worth almost AU$55m

-

May 2021: CBA doubles profit YoY; cites surge in lending activity

-

June 2021: CBA sells general insurance business to Hollard for AU$625m

Westpac (ASX: WBC)

-

September 2020: Westpac hit with $1.3b money laundering fine; biggest in Australian corporate history

-

November 2020: Profit drops by two-thirds due to recession and money laundering fine

-

December 2020: Westpac vows to bring back proper dividends in 2021

-

February 2021: Share price climbs following Q1 earnings update

-

March 2021: CBA reveals plans to launch BNPL service

-

May 2021: Reports significantly lower cash earnings in Q3 report

National Australia Bank (ASX: NAB)

-

August 2020: Q3 results better than expected for NAB

-

October 2020: NAB to add 500 jobs to cope with influx of financial hardship claims

-

November 2020: Cash profits down 37% as NAB sees impact of COVID

-

April 2021: Plans to shut down physical branches across the country as customers choose online banking

-

May 2021: NAB yet to see business banking recovery; cash earnings and revenue down in interim results

Track your SMSF investments with Sharesight

Get access to insights like this by tracking your SMSF investments along with the rest of your portfolio using Sharesight. Built for the needs of SMSF trustees like you, with Sharesight you can:

-

Organise holdings according to your documented SMSF asset allocation and investment strategy, providing valuable insights throughout the year

-

Easily share SMSF portfolios with accountants or financial professionals to make admin and tax compliance a breeze

-

Track SMSF investment performance with prices, dividends and currency fluctuations updated automatically

-

Run powerful tax reports built for Australian investors, including Capital Gains Tax, Unrealised Capital Gains, and Taxable Income (dividend income)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a product recommendation, or taxation or financial advice and should not be relied upon as such. Always check with your financial adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.

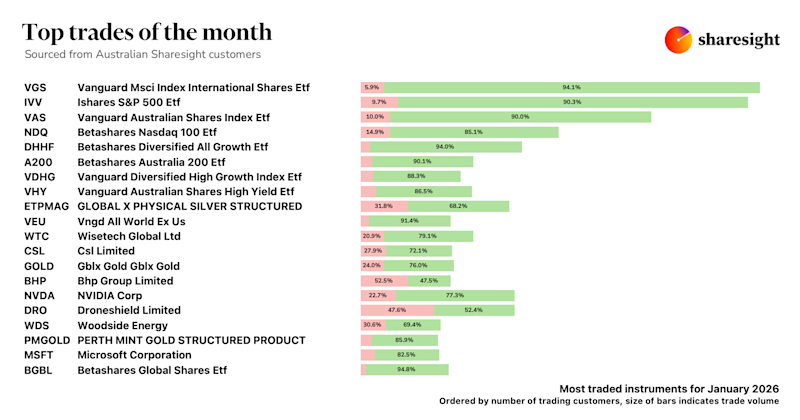

Top trades by Australian Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for Australian investors, where we look at the top 20 trades made by Australian Sharesight users.