Top 20 ASX trades by Sharesight users – February 2023

Welcome to the February 2023 edition of Sharesight’s monthly ASX trading snapshot, where we look at the top 20 trades Sharesight users made on the ASX during the month.

In this snapshot, buy trades were strongly led by Vanguard’s Australian Shares Index ETF (ASX: VAS). In terms of individual stocks, buy and sell trades were led by Whitehaven Coal (ASX: WHC), which announced record profit in its half-year financial results. Trades were followed by Commonwealth Bank (ASX: CBA), which also posted strong earnings results amid rising interest rates. It was a mining-heavy month overall, with 9 of the top 20 trades belonging to stocks in the mining sector.

Top 20 ASX trades February 2023

Let’s look at the news behind some of the key stocks in this month’s snapshot:

Whitehaven Coal (ASX: WHC)

-

Strong Narrabri performance underpins record financial result for Whitehaven Coal

-

Share price drops despite 423% profit growth

-

Invests AU$2 million in new Gunnedah Koala Sanctuary

Commonwealth Bank (ASX: CBA)

-

Interest rate rises propel CBA profit to AU$5.15 billion

-

CBA share price on watch following strong earnings results and AU$1 billion share buy-back

-

Share price sinks 6% amid concerns the bank’s net interest margin has peaked

Pilbara Minerals (ASX: PLS)

-

Pilbara Minerals announces 989% profit surge

-

Share price rises following strong earnings results; maiden dividend announcement

-

Pilbara Minerals POSCO JV granted AU$683 million loan for South Korean lithium chemical facility

BHP (ASX: BHP)

-

BHP profit falls 32% amid low iron ore prices

-

Confirms plans to sell off Blackwater and Daunia coal mines

-

Union demands job security for workers at soon-to-be-sold QLD mines

Westpac (ASX: WBC)

-

Westpac share price drops following mixed quarterly results

-

Signs 5-year deal with Amazon Web Services to expand cloud services

-

Postpones closure of regional bank branches ahead of Senate inquiry

Woodside Energy (ASX: WDS)

-

Woodside share price is up over 30% YoY

-

Woodside profit hits record high due to BHP merger and soaring oil and gas prices

-

Share price rises following strong earnings results

ANZ (ASX: ANZ)

-

ANZ shares fall following quarterly results

-

Announces AU$50 million investment in View Media Group

-

Leading broker cites ANZ shares as ‘top pick’ in banking sector

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

-

Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation and future income

-

Run tax reports including taxable income (dividends/distributions), Capital Gains Tax (Australia and Canada), Traders Tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Sharesight product updates – May 2024

This month's focus was on expanding our broker support and streamlining the customer onboarding journey, as well as additional reporting and holding functions.

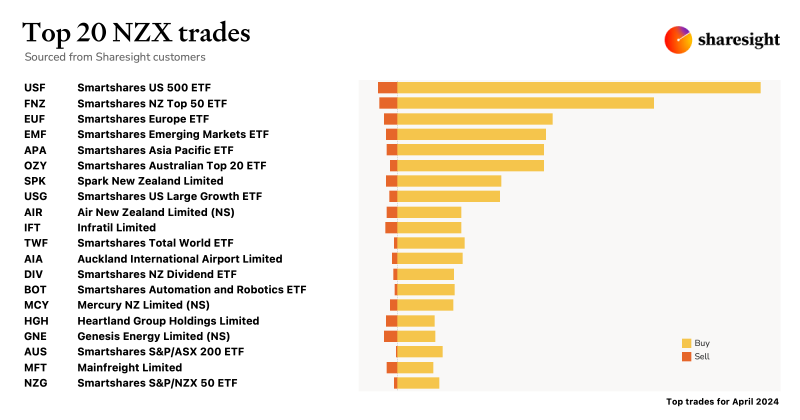

Top 20 NZX trades by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly NZX trading snapshot, where we look at the top 20 trades Sharesight users made on the NZX.

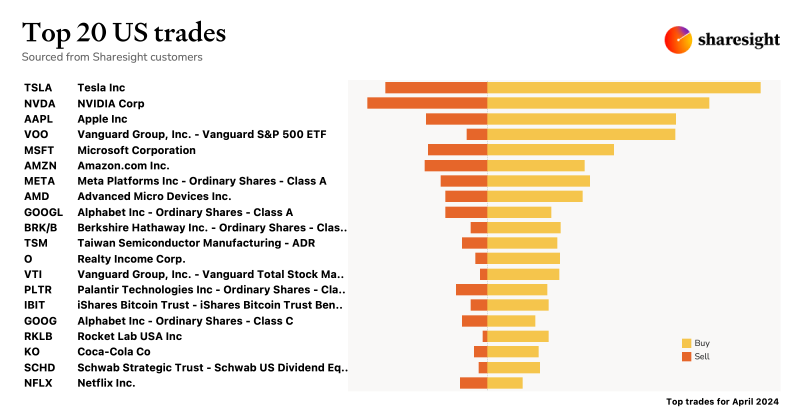

Top 20 trades in US stocks by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly USA trading snapshot, where we look at Sharesight users’ top 20 trades in US stocks.