Top 20 ASX trades by Sharesight users – November 2022

Welcome to the November 2022 edition of Sharesight’s monthly ASX trading snapshot, where we look at the top 20 trades Sharesight users made on the ASX during the month.

In this snapshot, buy trades were strongly led by Vanguard’s Australian Shares Index ETF (ASX: VAS), followed by the ETF provider’s MSCI Index International Shares ETF (ASX: VGS). In terms of individual stocks, buy trades were led by Pilbara Minerals (ASX: PLS), which recently announced a joint venture with clean tech company Calix. At the same time, sell trades were led by Core Lithium (ASX: CXO), which saw its share price hit an all-time high in November. It was a mining-heavy month overall, with 8 of the top 20 trades belonging to stocks in the mining and minerals sector.

Top 20 ASX trades November 2022

Let’s look at the news behind some of the key stocks in this month’s snapshot:

Pilbara Minerals (ASX: PLS)

-

Pilbara shares rise on announcement of Calix deal

-

Receives highest-ever bid for spodumene

-

Share price plummets alongside other lithium stocks

-

Pilbara share price is up 55% in 2022

Core Lithium (ASX: CXO)

-

Core Lithium share price drops 25% as investors fret over Chinese lithium demand

-

Share price hits all-time high amid reports of China easing COVID-19 restrictions

-

Could government intervention jeopardise lithium prices?

BHP (ASX: BHP)

-

Leading broker downgrades BHP share rating

-

BHP makes final offer of AU$9.6 billion for OzMinerals

-

Share price rises 9% in a week as iron ore and copper prices surge

Woodside Energy (ASX: WDS)

-

Woodside ships LNG to Europe in rare trade

-

Share price hits 8-year high amid soaring oil and gas prices

-

Share price is up 80% in 2022

Whitehaven Coal (ASX: WHC)

-

Whitehaven CEO sells AU$7.9 million-worth of shares

-

Coal mining now costs double 2016 levels, says Whitehaven

-

Whitehaven downgrades FY23 guidance following La Nina impacts

Xero (ASX: XRO)

-

Over AU$1 billion wiped off Xero market cap amid growing losses, CEO resignation

-

Xero appoints Sukhinder Singh Cassidy as new CEO

-

Leading broker sees 80% upside for Xero shares

New Hope Corporation (ASX: NHC)

-

New Hope plans to restart New Aceland coal mine after 15-year battle

-

Share price drops 8% following quarterly update; Chinese demand concerns

-

Share price is up 152% in 2022

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

-

Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

-

Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation and future income

-

Run tax reports including taxable income (dividends/distributions), Capital Gains Tax (Australia and Canada), traders tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

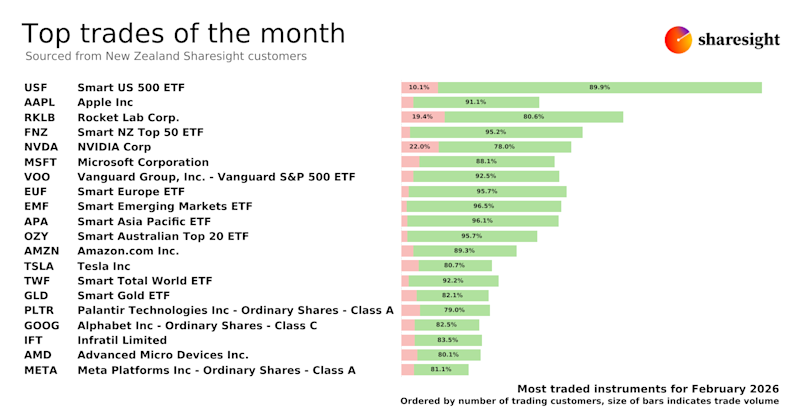

Top trades by New Zealand Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s monthly trading snapshot, where we look at the top 20 trades made by New Zealand Sharesight users.

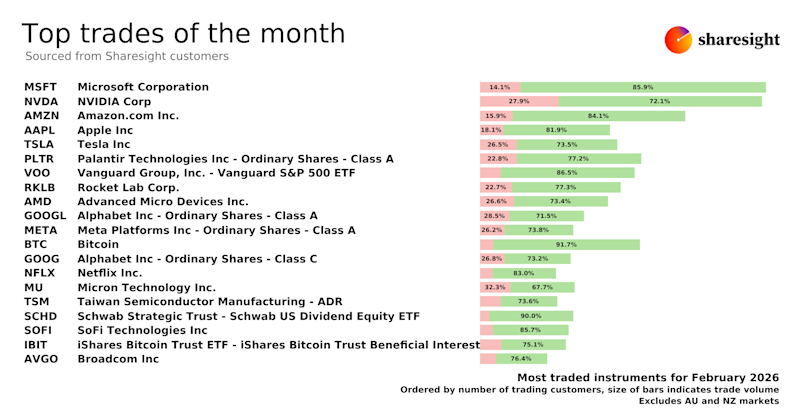

Top trades by global Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Sharesight users around the world.

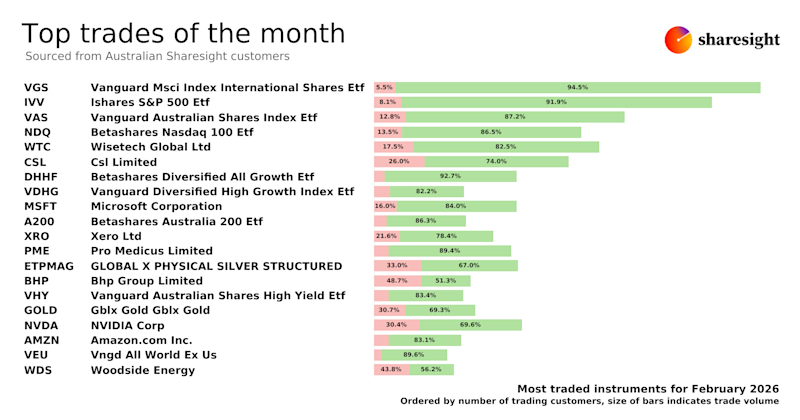

Top trades by Australian Sharesight users — February 2026

Welcome to the February 2026 edition of Sharesight’s trading snapshot, where we look at the top 20 trades made by Australian Sharesight users.