All your investments in one place, not all over the place.

Track shares and ETFs from over 40 exchanges worldwide, plus Australian LICs and managed funds. You can also track cash and over 100 currencies, as well as unlisted investments such as fixed interest and investment properties.

Sign up for free

Know your true performance

See the true performance of all your holdings – no matter where they live.

Track multiple asset classes

Track private equity, alternatives, real estate and more – all in a single place.

Make insight-driven decisions

Drive financial decisions knowing your end-of-day dynamic wealth position.

Swap your investment spreadsheet for Sharesight

Managing your investment portfolio used to involve hours spent manually updating a spreadsheet. Online investment portfolio tools like Sharesight make it easy.

Powerful investment performance & tax reports

Track investment performance over any period

Calculate the impact of capital gains, dividends and currency fluctuations on your portfolio with the Performance Report. Break down your performance along a range of preset and custom dimensions including country, market, industry and more. Compare how different investments perform within your portfolio and add custom labels to further filter the report.

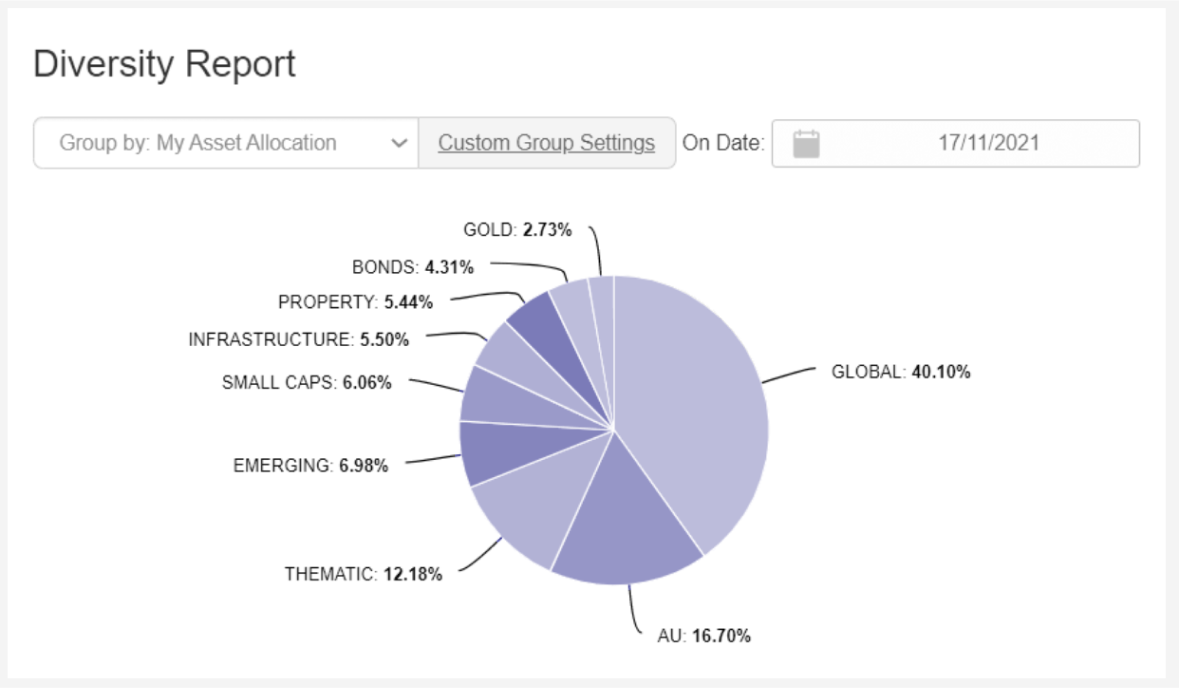

Visualise your portfolio diversity

Track your asset allocation and calculate your portfolio diversity across FACTSET investment classifications or your own groupings with the Diversity Report. This makes it easy to rebalance your portfolio to your target asset allocation.

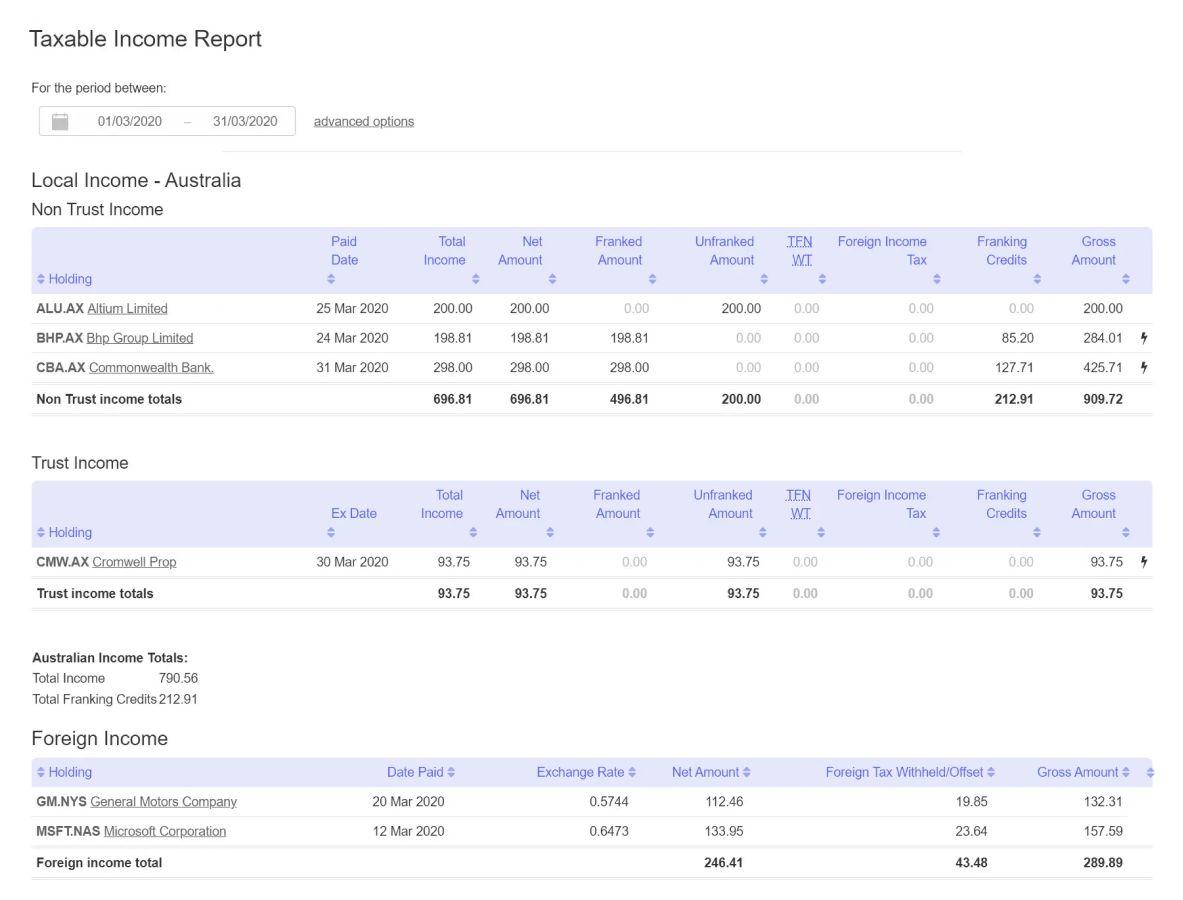

Track all your investment income

Report your investment income from dividends, distributions and interest payments, broken-up by local Australian (non-trust and trust) income and foreign income with the Taxable Income Report.

Built for Australian investors, the report includes all franking credits earned during the financial year. With historical dividend data going back over 20 years the report can be run at any time, over any time period to help you complete your tax return.

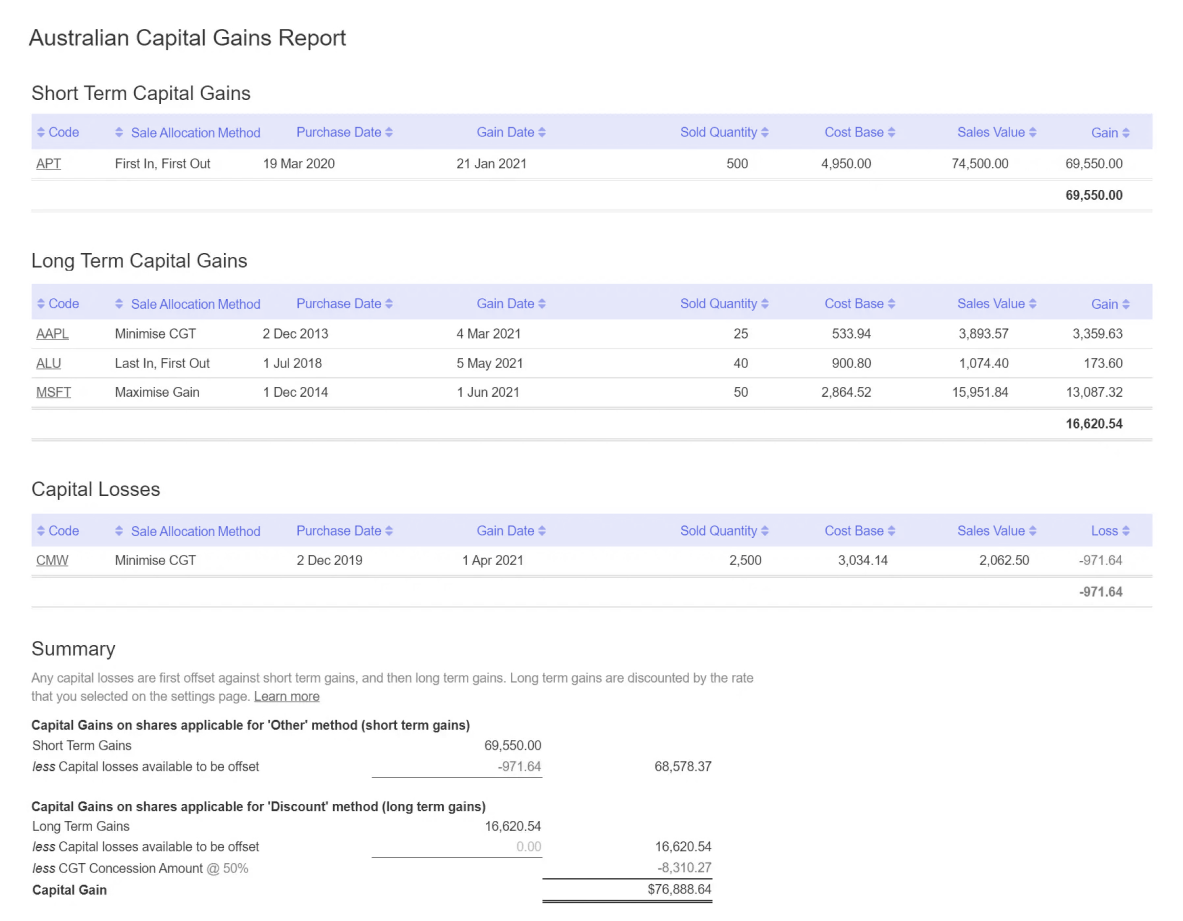

Calculate your capital gains tax

Calculate your capital gains on investments as per Australian Tax Office (ATO) rules with the Capital Gains Tax Report. You can also optimise your tax position by comparing sales allocation methods and parcel cost bases.

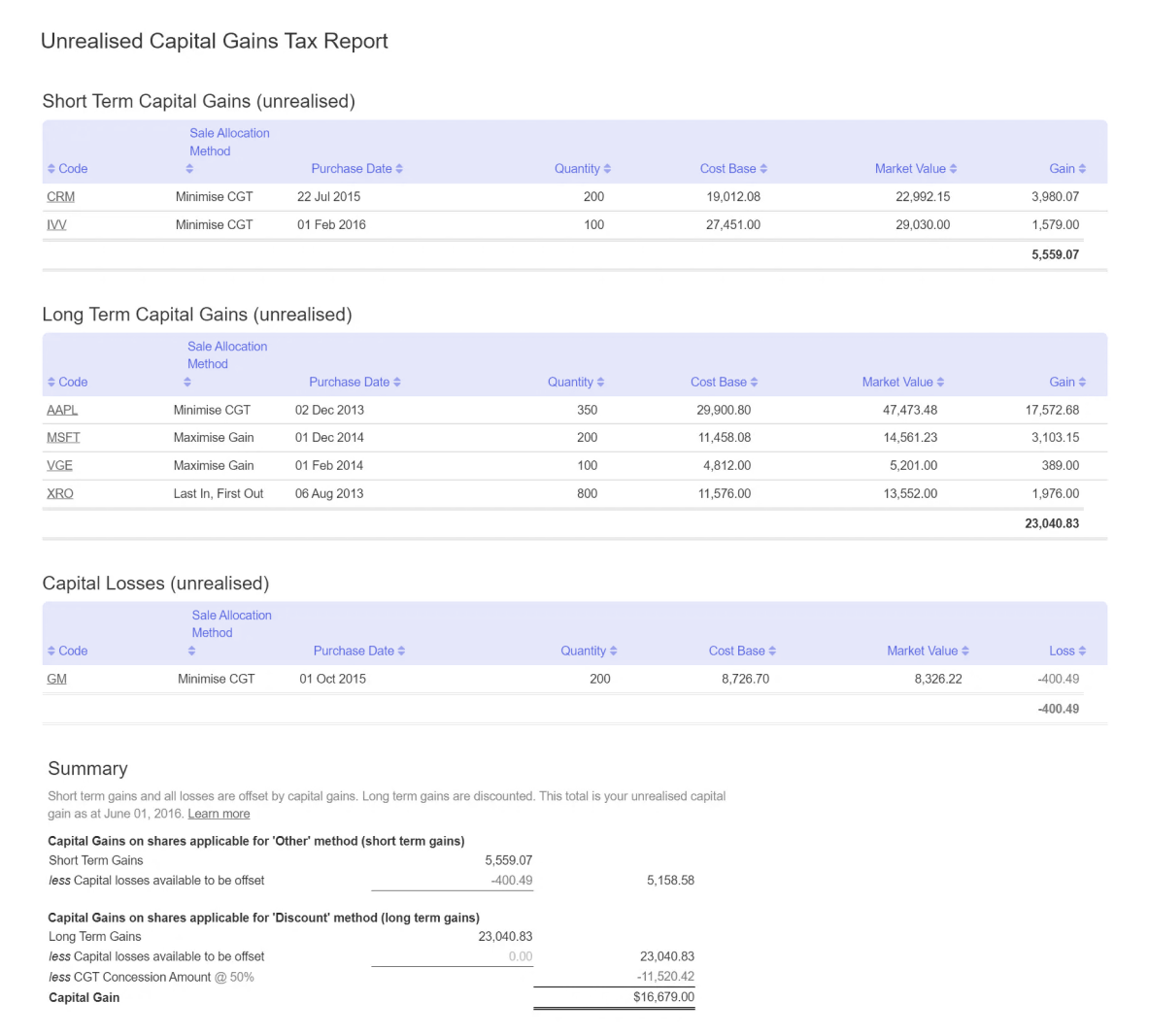

Offset your capital gains

Take advantage of tax loss selling by using the Unrealised CGT Report to model the net capital gains tax that would occur across your portfolio by selling down a mix of investments in your portfolio. With the ability to modify the CGT sale allocation method for each investment sold, you can optimise your capital gains tax position across your portfolio.

Built for Australian investors

Investors just like you use Sharesight to get all the info they need to report investment income as part of their tax returns with the ATO.

Australian tax rules

CGT discounts are automatically calculated based on your tax entity: Individual/Trust, SMSF or Company.

Franking credits

See all your dividends automatically tracked, with a breakdown of franked and unfranked dividend income.

SMSF record-keeping

Automatically record all trades & dividends, and connect to Xero to reconcile with your bank account.

Upload your holdings, and we’ll take it from there

Upload your holdings

Sign up and add your holdings – either by connecting to your broker, uploading a spreadsheet, or manually entering your trading history or opening balance.

Get automatic updates

Sit back and watch as corporate action data (such as dividends and stock splits) are automatically incorporated – going back up to 20 years, and ongoing.

Gain powerful insights

Graph your performance, benchmark your portfolio against market indexes, see your asset allocation, and visualise your portfolio diversity by market, sector, country, and more.

Don't just take our word for it

Over 500,000+ investors track their investments with Sharesight. Here’s what a few of them have to say:

500

k+

700

k+

200

Plans & Pricing

Start by tracking up to 10 holdings for free! Then upgrade to a premium plan at any time to track additional holdings or portfolios, and unlock advanced features. And as a bonus, your Sharesight subscription may be tax deductible. *

Free

$0

Forever

Starter

$16.97

AUD per month

billed annually

$25.33 AUD billed monthly

Investor

$25.91

AUD per month

billed annually

$38.67 AUD billed monthly

Expert

$43.77

AUD per month

billed annually

$65.33 AUD billed monthly

Award-winning portfolio tracking

Get 33% off an annual premium plan when you upgrade within 120 days of signing-up. Open to new or existing Free plan users only. May not be combined with other offers. The 33% discount applies when comparing our standard monthly subscription fee against the annual pre-paid offer subscription fee.