Track your CMC Markets portfolio with Sharesight

If you’re an Australian investor trading via CMC Markets, you can automatically sync your trading data to Sharesight, allowing you to seamlessly track the performance of your investments. With support for more than 200 leading global brokers, plus automatically updated price and dividend information on over 700,000 stocks, ETFs and funds, Sharesight is the ultimate tool to track all of your investments in one place. Keep reading to learn more about the benefits of tracking your performance in Sharesight, and how you can connect your CMC account to Sharesight.

Who is CMC Markets?

CMC Markets is a UK-based financial services company with an online brokerage platform for Australian investors, known as CMC Invest. The platform provides access to a wide range of Australian and international stocks, ETFs, and other investment products. Investors can trade on major global markets, including the US, UK, Canada, Japan, and several European and Asia-Pacific exchanges. CMC Invest also offers advanced trading tools, comprehensive investor education resources, and access to market analysis.

Why you should track your CMC trades with Sharesight

By importing your Interactive Brokers trades to Sharesight, you can easily track your investment performance across different brokers, asset classes and markets. You will also gain access to Sharesight’s automatic dividend tracking, plus advanced performance and tax reporting tools designed for self-directed investors.

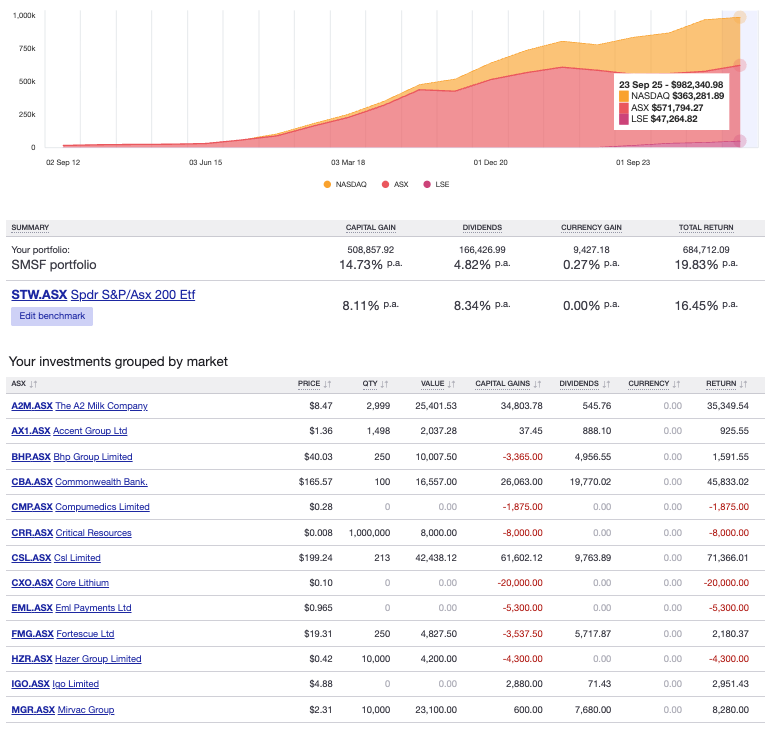

Importantly, Sharesight takes into account the impact of capital gains, dividends, brokerage fees and FX fluctuations when calculating returns – giving you the complete picture of your portfolio’s performance. Sharesight also offers a range of powerful reports including performance, portfolio diversity, contribution analysis, risk, multi-currency valuation, multi-period, exposure and future income. The ability to track cash accounts, property and even cryptocurrency is just another reason you should consider using Sharesight to track your investment portfolio.

Track your dividend income

Unlike other portfolio trackers, Sharesight automatically tracks dividend and distribution income (including franked dividends and dividend reinvestment plans) and takes this into account when calculating your investment return. In the screenshot below for example, dividends make a significant contribution to this stock’s returns, highlighting the value of a portfolio tracking solution that includes more than just capital gains in its performance calculations.

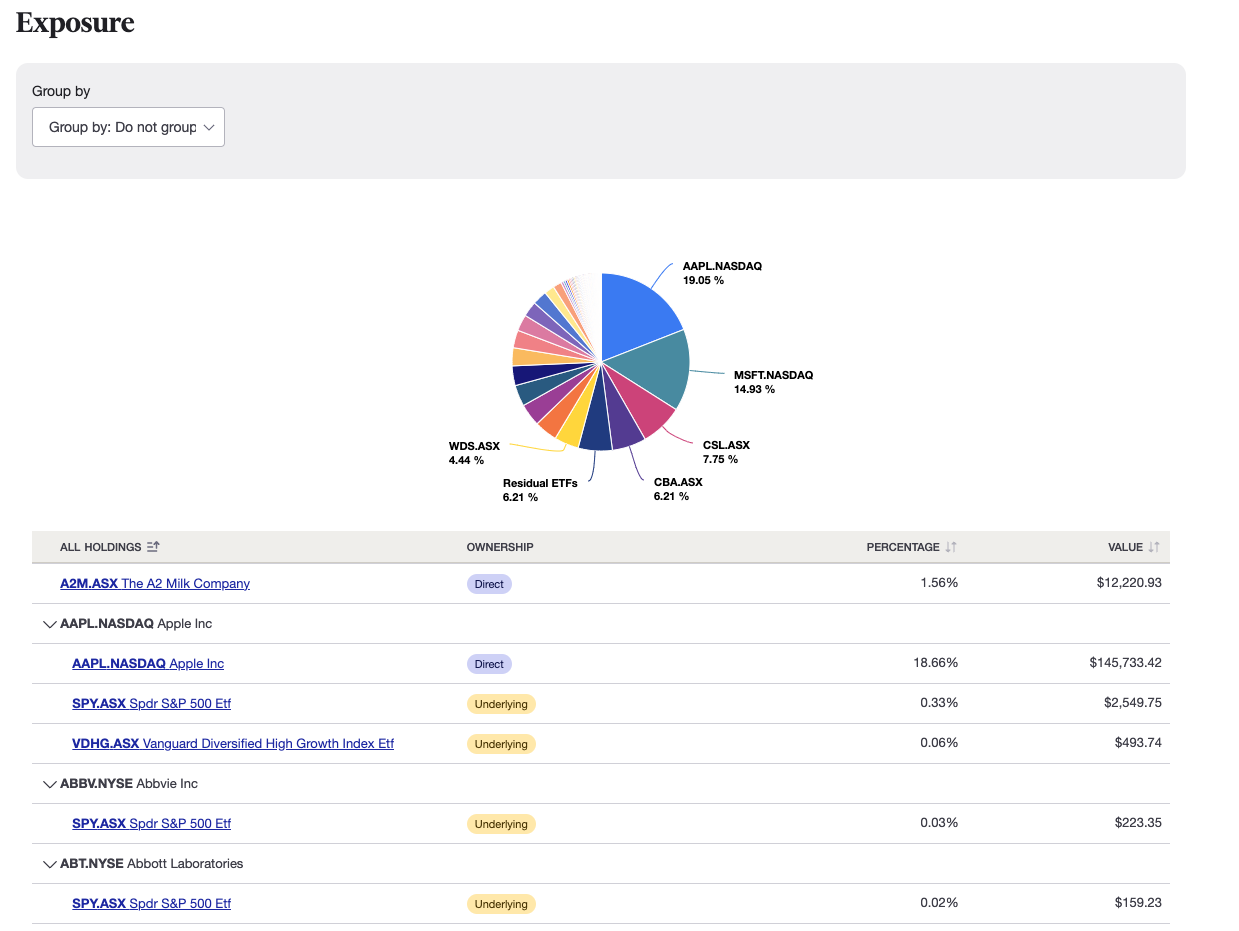

See your exposure across asset classes, sectors and regions

Available on starter, standard and premium plans, Sharesight’s exposure report reveals your portfolio’s exposure to different sectors, asset classes, regions, currencies and more. The report lists your direct stock holdings alongside any stocks held within ETFs, which helps you identify any unnecessary overlap in your portfolio.

How to import your CMC trades to Sharesight

You can easily establish a connection between your CMC and Sharesight accounts to automatically sync your trading history and any future trades to your Sharesight portfolio. Alternatively, you can upload your trading history via spreadsheet.

Connect your CMC account to Sharesight

First of all, if you’re new to Sharesight, you can get started by signing up for a free account.

Once you have a Sharesight account, you can establish a connection between CMC and Sharesight by signing into your CMC account, navigating to the Account dropdown, selecting Tax & Portfolio Reporting and following the instructions provided. Once the connection is established, the past 12 months of your trading history will be automatically synced to your Sharesight portfolio, as well as any future trades that you make.

For more information, see the video below:

Note: CMC’s integration with the Sharesight API means none of your CMC account details will be visible to Sharesight, and your trading data is downloaded through a secure connection. You can revoke the connection to Sharesight at any time.

Import trading history via spreadsheet

If you have more than 12 months of trading history that you would like to import to your Sharesight portfolio, you can do this by downloading a spreadsheet file of trades from your CMC account and uploading this to Sharesight.

For more information, see the video below:

Start tracking your trades from CMC with Sharesight

Join thousands of Australian investors already using Sharesight to manage their investment portfolios. With Sharesight you can:

- Automatically track your dividend and distribution income from stocks, ETFs, LICs and mutual/managed funds – including the value of franking credits

- Use the dividend reinvestment plan (DRPs/DRIPs) feature to track the impact of DRP transactions on your performance (and tax)

- See the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful tax reports to calculate your dividend income with the taxable income report

- Plus calculate your CGT obligations with Sharesight’s Australian capital gains tax report and unrealised capital gains tax report

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

Sharesight product updates – January 2026

Our latest updates include Abu Dhabi exchange support, enhanced dividend insights, overview page refinements, mobile app improvements and more.

2026 market outlook: Expert insights on risks, rates and opportunities

We talk to industry experts about their expectations for markets in 2026 — from inflation and interest rates to market opportunities, the AI bubble and more.

Sharesight users' top trades – December 2025

Welcome to the December 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users over the month.