Latest posts

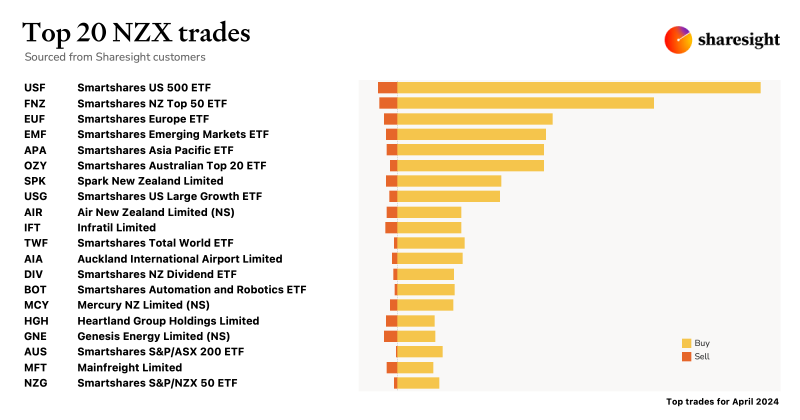

Top 20 NZX trades by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly NZX trading snapshot, where we look at the top 20 trades Sharesight users made on the NZX.

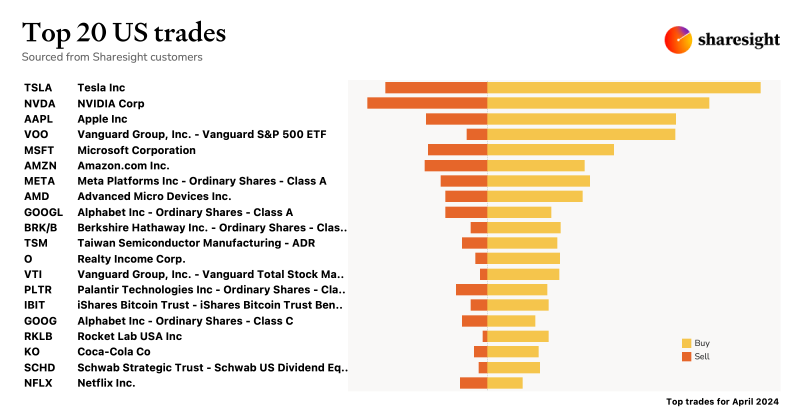

Top 20 trades in US stocks by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly USA trading snapshot, where we look at Sharesight users’ top 20 trades in US stocks.

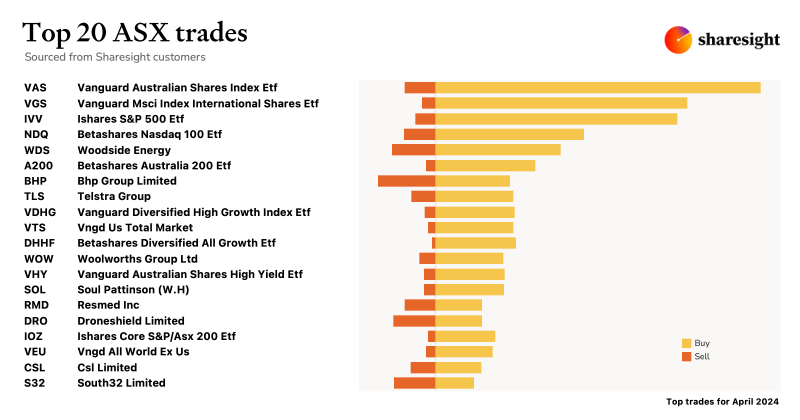

Top 20 ASX trades by Sharesight users – April 2024

Welcome to the April 2024 edition of Sharesight’s monthly ASX trading snapshot, where we look at the top 20 trades Sharesight users made on the ASX.

Announcing the Sharesight Fintech Scholarship's 2024 winner

We are pleased to announce the 2024 winner of the Sharesight Fintech Scholarship, Temiremi Egwuenu, who is studying Applied Finance at Macquarie University.

Effortlessly track clients’ trades with Sharesight and Desktop Broker

Sharesight has integrated with Desktop Broker, allowing advisers to have their clients’ trading data automatically synced to Sharesight’s portfolio tracker.

Red flags: When should you avoid investing in an asset?

This article explores some of the “red flags” you should look out for when considering an investment for your portfolio.

Track stocks on the London Stock Exchange with Sharesight

With Sharesight, you can automatically track the price and performance of thousands of stocks and ETFs on the London Stock Exchange (LSE).

Track your TFSA with Sharesight

You can easily track your Tax-Free Savings Accounts (TFSAs) in Sharesight, in addition to your non-registered, RRSP and RRIF accounts.

Sharesight product updates – April 2024

This month we wrapped up a number of long-term projects, including security enhancements, additional broker support and our new holdings page.

How Nikky uses Sharesight to understand her true performance

Part of our Sharesight customer experience series, this blog features Nikky W., an investor who has been tracking her portfolio with Sharesight since 2020.

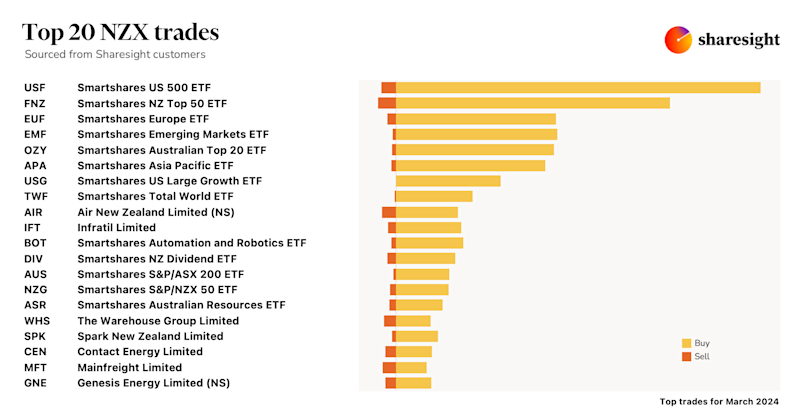

Top 20 NZX trades by Sharesight users – March 2024

Welcome to the March 2024 edition of Sharesight’s monthly NZX trading snapshot, where we look at the top 20 trades Sharesight users made on the NZX.

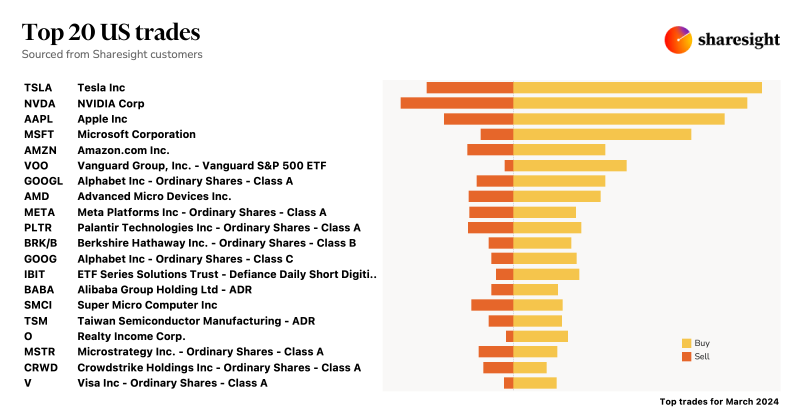

Top 20 trades in US stocks by Sharesight users – March 2024

Welcome to the March 2024 edition of Sharesight’s monthly USA trading snapshot, where we look at Sharesight users’ top 20 trades in US stocks.