Track your TFSA with Sharesight

If you’re a Canadian investor, you can automatically track your tax-free savings account (TFSA) with Sharesight, inclusive of cash deposits and withdrawals, as well as income from investments in stocks, ETFs and mutual funds. This allows you to track the performance of all your investments in one place, while leveraging Sharesight’s award-winning performance, dividend tracking and tax reporting. To learn more about TFSAs and how you can track them in Sharesight, keep reading.

What is a TFSA?

Introduced in Canada in 2009, a tax-free savings account (TFSA) is an account in which individuals who are 18 or over with a valid social insurance number can put aside money tax-free. Money deposited as well as income earned in the account (such as interest, dividends and capital gains) is non-taxable and can be withdrawn tax-free. While a TFSA is a form of savings account, it can also hold certain investments including mutual funds, shares and bonds.

How to track your TFSA in Sharesight

To track a TFSA in Sharesight, simply set the tax entity of your portfolio to ‘TFSA’. This can be done by accessing the Settings menu and clicking ‘Tax settings’. By setting a Sharesight portfolio to ‘TFSA’, this means all Canadian payouts will be considered non-taxable by default (which can be overridden if necessary), however non-resident withholding tax will still apply.

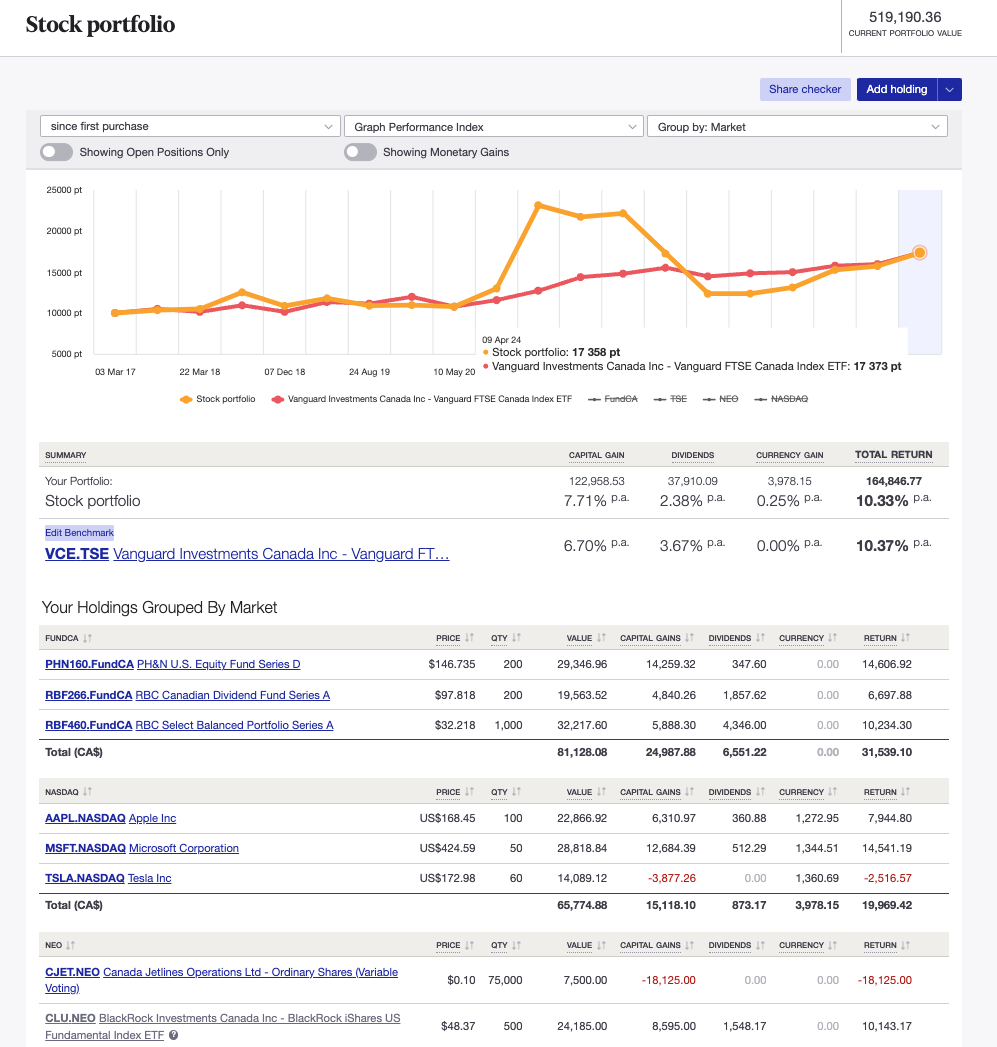

As can be seen in the screenshot below, a TFSA can be tracked in Sharesight just like any other portfolio type, with the ability to automatically track capital gains and dividends from investments, plus see the value of any deposits or withdrawals by tracking a cash account. You can also benchmark your TFSA against any one of the 500,000+ global stocks, ETFs and funds that Sharesight tracks, which is a good way of understanding your TFSA’s performance in a broader market context.

An example of a Canadian TFSA being tracked in Sharesight.

Tax entities available for Canadian portfolios

| Tax Entity Type | Notes |

| Non-registered | Standard tax rules apply. |

| Registered Retirement Savings Plan (RRSP) | Non-resident withholding tax does not apply for US stocks. |

| Registered Retirement Income Fund (RRIF) | Non-resident withholding tax does not apply for US stocks. |

| Tax-Free Savings Account (TFSA) | Income from Canadian investments will be treated as non-taxable by default and not appear on the Taxable Income Report. Non-resident withholding tax still applies. |

Track your investment performance across all of your portfolios

With Sharesight, not only can you track the performance of all your TFSA investments, but you can also track the performance of all your different investment portfolios and accounts in one place. This is made easy with Sharesight’s consolidated views feature, which allows you to see performance across all your portfolios in a single view, including when running most reports. For example, a consolidated view could be useful when running the performance, diversity or contribution analysis reports, as it allows you to see your asset allocation and top-performing investments across all of your portfolios at a glance.

Start tracking your TFSA with Sharesight

If you’re not already using Sharesight to track your TFSA along with the rest of your investments, what are you waiting for? It’s free to sign up, and with Sharesight you can:

- Import historical trades from top Canadian brokers such as Questrade, Scotiabank, TD Direct, RBC Direct Investing and many more, including over 200 global brokers

- Track trades from over 60 global stock exchanges, including the Toronto Stock Exchange, Canadian Securities Exchange, NEO Exchange and Toronto TSX Ventures Exchange

- Track over 40,000 canadian mutual funds, with more than 20 years of historical price and distribution data. Ongoing prices and distributions are automatically updated and editable at any time

- Track Canadian and foreign currencies, including 8 different cryptocurrencies

- Calculate your CGT with the Canadian capital gains tax report

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Key takeaways from SIAA 2025: Trends, insights & industry highlights

We summarise the key takeaways from the 2025 SIAA conference in Sydney, covering industry insights, market trends and the future of financial advice.

5 ways Sharesight keeps your data safe

Here at Sharesight, we maintain constant vigilance around cyber security. In this blog, we discuss five ways Sharesight keeps your data safe.

The investor's guide to IPOs: Risks, rewards and strategies

Discover when to invest in IPOs, how to approach them strategically, and how Sharesight helps you track and optimise your performance.