Sharesight users' top 20 trades in TSX stocks for 2023

Each year, Sharesight looks back at the top 20 buy and sell trades made by Sharesight users throughout the year. Welcome to the 2023 edition of our annual trading snapshot, where we explore the top trades users made in stocks on the Toronto Stock Exchange (TSX), plus the market-moving news behind some of these stocks.

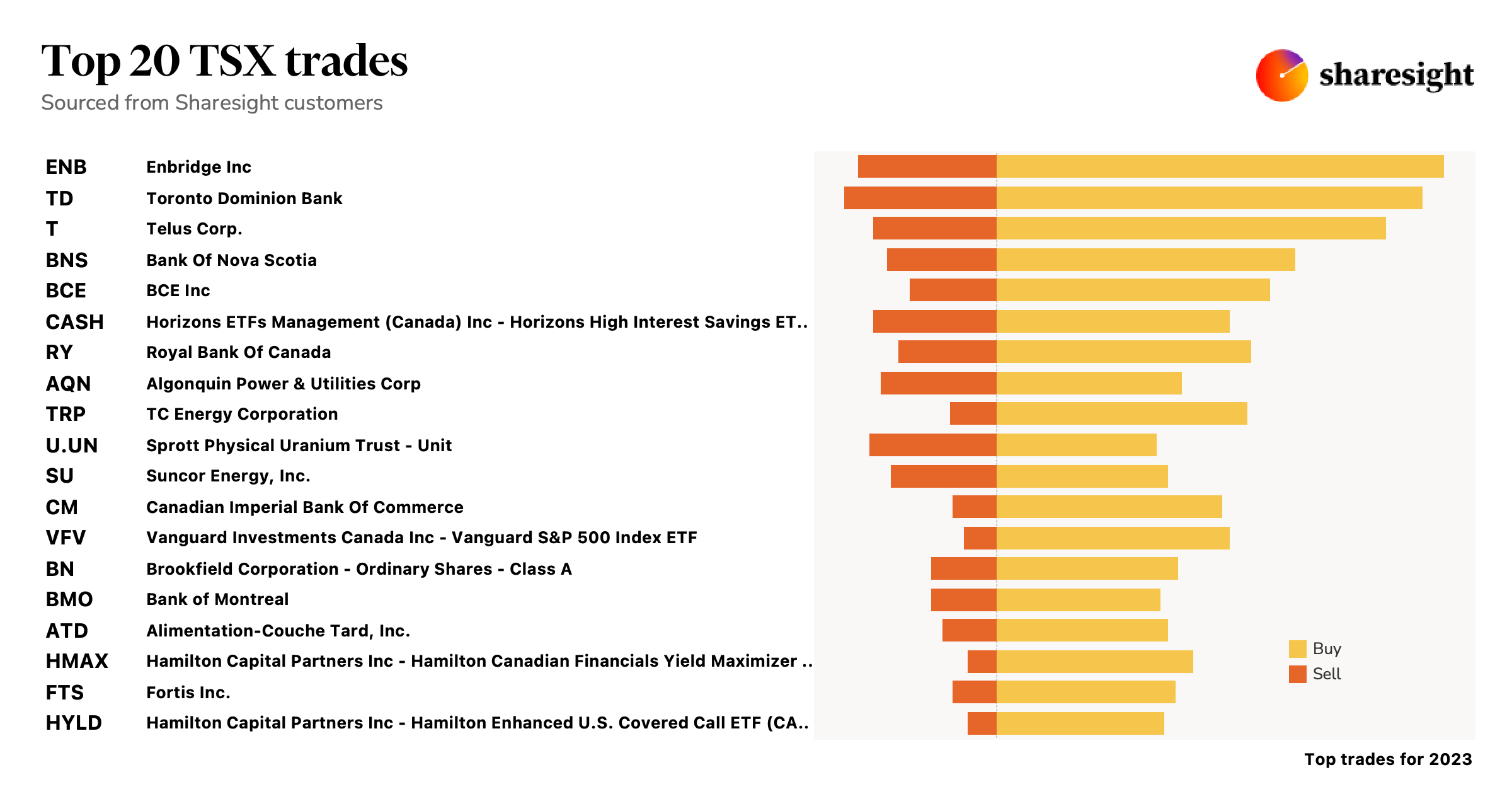

Top 20 TSX stocks traded in 2023

In this annual snapshot, buy trades were led by Enbridge (TSX: ENB), which saw its share price gradually decline throughout 2023, ultimately ending the year down over 8% (as at the time of publishing). Sell trades were led by Toronto Dominion Bank (TSX: TD), which saw its share price peak in February before plummeting steeply in March and stabilising throughout the rest of 2023, ending the year down over 3%. Overall, it was a year dominated by trades in banking and energy stocks, with half of the top 20 trades belonging to stocks in these sectors.

Let’s look at the news behind some of the key stocks in this year’s snapshot:

Enbridge (TSX: ENB)

- May: Enbridge share price drops despite better-than-expected Q1 earnings

- September: Enbridge shares hit 2-year low following announcement of Dominion Energy acquisition

- November: Enbridge profit beats analysts’ expectations

- December: Pembina Pipeline to buy Enbridge’s JV interests for CAD$3.1 billion

Toronto Dominion Bank (TSX: TD)

- April: TD named world’s most shorted banking stock

- July: TD shares fell 6.3% in the first half of 2023

- August: Quarterly profit falls on rising loan-loss provisions

- December: TD reports weak Q4 earnings amid layoffs and loan-loss provisions

Telus Corp (TSX: T)

- January: Telus acquires WillowTree for CAD$1.2 billion

- May: Q1 earnings miss estimates; revenue rises YoY

- November: Telus CEO purchases CAD$10 million-worth of shares

- December: Telus faces 400% increase in copper wire thefts in Calgary

Bank of Nova Scotia (TSX: BNS)

- March: Scotiabank shares plummet on lacklustre Q1 earnings

- May: Shares fall as Scotiabank misses profit estimates

- August: Shares rise despite Q3 earnings miss

- November: Scotiabank falls short of quarterly profit forecasts; expects ‘marginal’ 2024 growth

Royal Bank of Canada (TSX: RY)

- April: RBC becomes world’s largest financier of fossil fuels

- May: Misses profit estimates due to higher loan-loss provisions

- August: Plans to cut thousands of jobs

- December: RBC to take over HSBC Canada in CAD$13.5 billion deal

Algonquin Power (TSX: AQN)

- April: Algonquin Power terminates deal to acquire Kentucky Power

- June: Hedge fund Starboard purchases 5% stake in Algonquin

- August: Considers sale of renewable energy arm

- November: Narrows loss in Q3, however revenue falls more than expected

TC Energy: (TSX: TRP)

- April: TC Energy beats Q1 profit estimates

- July: Shares drop on oil pipeline spinoff plans

- October: TC Energy plans to sell US$10 billion-worth of assets

- December: TC Energy’s Coastal GasLink sues pipeline contractor for CAD$1.2 billion over delays

Track your investment portfolio with Sharesight

Get access to Sharesight20 insights like this by tracking your investment portfolio with Sharesight. Built for the needs of investors like you:

- Track all your investments in one place, including stocks, mutual/managed funds, property, and even cryptocurrency

- Get the true picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis and future income

- Run tax reports including taxable income (dividends/distributions), capital gains tax (Australia and Canada), traders tax (Capital Gains for traders in NZ) and FIF foreign investment fund income reports (NZ)

Sign up for a FREE Sharesight account and get started tracking your investments today.

Disclaimer: This article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Sharesight nominated for 2025 Wealth Tech Innovator of the Year

Sharesight has been chosen as a finalist in the 2025 Australian Wealth Management Awards, in the Wealth Tech Innovator of the Year category.

Prepare your annual accounts with our historical cost report

Sharesight's historical cost report is a powerful tool for investors who need to prepare annual accounts or financial statements with mark-to-market accounting.

Sharesight product updates – July 2025

This month's focus was on rolling out predictive income forecasting, as well as improved cash account syncing across different brokers and currencies.