What to avoid when investing: Event wrap-up

The below article is for informational purposes only and does not constitute a product recommendation, or taxation or financial advice and should not be relied upon as such. Please check with your adviser or accountant to obtain the correct tax treatment for your situation.

The team from Sharesight hosted a panel of speakers this week on behalf of the Finimize Sydney community to discuss ‘What to Avoid when Investing’.

Some of the mistakes investors make are pretty common and it helps to learn from other investors to avoid these common traps.

Attendees learned about the problems of investing based on emotion, the need to do your due diligence when researching stocks to invest in, and when to know when it’s the right time to exit an investment.

Event panelists and moderator

The panel brought a range of experience to the event and included:

-

Doug Morris - CEO Sharesight

-

Ted Richards - Director of Business Development at Six Park

-

Kylie Parker - Director at Lotus Accountants

-

Claude Walker - Founder of Ethical Equities

Moderating the panel was Phil Muscatello who hosts the Shares for Beginners Podcast.

Listen to the event here

The event was recorded and you can listen to the audio below, or read the key highlights underneath.

Key event highlights

Key responses from our panelists are paraphrased below:

What is the most memorable investing mistake that you’ve made

Claude: One of the first investments I made went to zero -- really underpinned the need to do my research and not ignore contrary information to my thesis.

Doug: Getting burned on the GFC with a short real estate ETF, unfortunately I didn’t do my research and fully read the prospectus -- the instrument reset itself each day, with admin fees taken out.

Ted: When I started out I thought I knew everything about investing, bought into Pacific Brands thinking they mostly owned Bonds and I knew all about that brand, but they actually own a large number of brands -- not all of which performed strongly.

Does it come down to emotions then?

Claude: If I’ve not picked the risk, it ultimately comes down to a mistake on my part and you have to live with those - just don’t lose the lesson.

What is Robo-advice in relation to financial planning?

Ted: I don’t think anything is going to replace quality face-to-face advice, but what we do at Six Park, which can be called ‘robo-advice’ -- it’s a form of advice that’s done online -- there’s no robots or cyborgs -- it’s real humans -- not the sort of holistic financial advice you might receive face to face, but can be a part of that.

Kylie: The best financial planners I’ve seen are those that do that sort of holistic financial planning, they do the risk profile, estate planning and bring the family into the process -- one financial planner I work with always says wealth creation is the process of accumulation. The good financial planners are just "Let’s start putting $25,000 away in your SMSF, if you start that early, that’s how you get rich".

What about tax?

Kylie: Make sure you're investing under the right tax structure, as if you're in a high tax bracket already, buying and selling stocks could mean you'll pay a lot more in tax -- and eating into your gains.

Questions from the audience

How do you decide when you’re past that point with an investment you need to get out?

Claude: When you make an investment you need to go in with a thesis on how you think it will turn out, if the share price is dropping that’s a clear sign to check the thesis and confirm it still holds up.

Doug: For me it’s about discipline, writing down a thesis, and putting in some notes on a Google Keep note and checking in on that, a 10% drop is a good chance to reevaluate.

Ted: For me, I like to hold a premortem, rather than a post mortem.

Kylie: For me I’m so overweight in Xero after buying them when they first listed in Australia, something I need to reevaluate.

What sources do you look at?

Doug: I would go to morningstar.com for US stocks or morningstar.com.au for Aus stocks -- or go direct to the company reports and read those - that’s where I always start -- factual information.

Claude: I just want to double down on primary documents -- look at company annual reports and profit and loss statements -- if you don’t understand, Google for answers. Newsletters are useful for suggesting stocks to maybe take a look at, but always go for the primary documents during your process.

Kylie you mentioned women tend to invest differently, and Ted you mentioned over-confidence, how do men and women invest differently?

Ted: At Six Park we look at the data analytics and can see who logs into the portfolio the most, and males typically who check their portfolio daily are more likely to change their risk profile and try and time the market, whereas women can be far more conservative and disciplined -- but also women are far more likely to keep money in cash, which may have negative impacts over time.

Kylie: I’d agree, but also add most of the female clients I have invest more in property, just due to that risk profile.

Thanks to everyone who participated in, and attended this event. We look forward to hosting more in the very near future, stay tuned to our Facebook and Twitter feeds for more info!

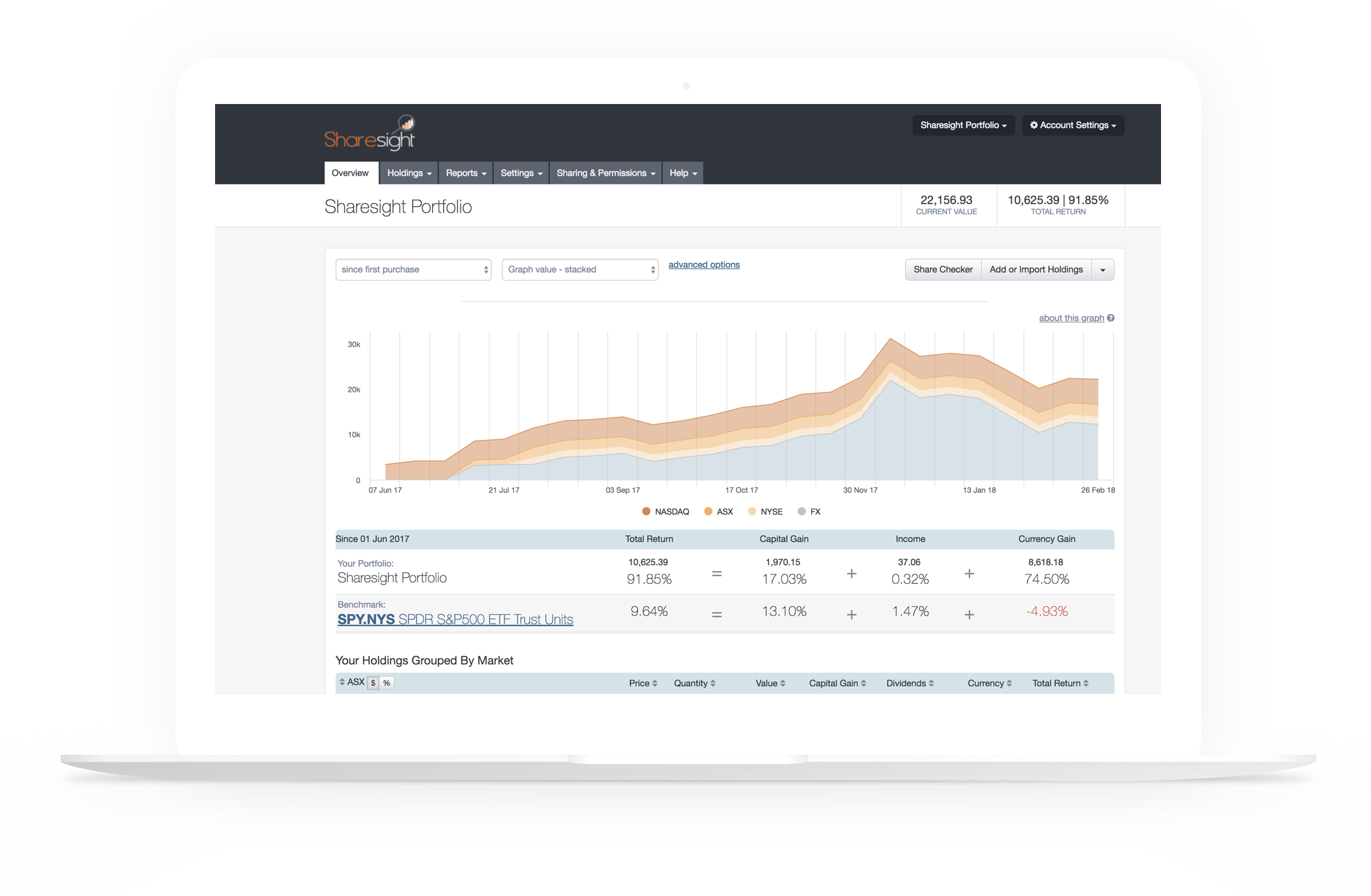

Global investors love Sharesight

Sharesight was built for the needs of international investors like you, and makes it easy to keep track of your global portfolio. Here’s how:

-

Automatically track your daily price & currency fluctuations, and handle corporate actions such as share splits.

-

Run powerful tax reports built for Australian investors, including Capital Gains Tax, Unrealised Capital Gains, and Taxable Income

-

See upcoming dividend payments with the Future Income Report.

-

Get the full picture of your investment performance, including the impact of brokerage fees, dividends, and capital gains with Sharesight’s annualised performance calculation methodology.

FURTHER READING

Sharesight users' top 20 trades – June 2025

Welcome to the June 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users in all markets.

Top SMSF trades by Australian Sharesight users in FY24/25

Welcome to our annual Australian financial year trading snapshot for SMSFs, where we dive into this year’s top trades by Sharesight users.

Top trades by Australian Sharesight users in FY24/25

Welcome to the FY24/25 edition of our Australian trading snapshot, where we dive into this financial year’s top trades by Sharesight users.