Why an investor chooses Sharesight over spreadsheets

Part of our customer experience series, this video features Marcus E., an investor who has been tracking his portfolios with Sharesight since 2018.

Marcus was looking for a simple online portfolio management solution and came across Sharesight, a solution that is able to grow with his changing investment needs.

For Marcus, Sharesight is all about the ability to go beyond a spreadsheet. Sharesight helps him to streamline his multiple portfolios, including his self-managed superannuation fund, personal portfolios, and his parents’ portfolios. With Sharesight, he also gains easy access to reporting insights for specific targeted requirements.

Watch the video to discover Marcus’ investing journey with Sharesight:

Embedded content: https://www.youtube.com/watch?v=gPkPqizr0nE

Ditch the spreadsheet with Sharesight

If you’re not already using Sharesight, what are you waiting for? Ditch the spreadsheet and start automatically tracking the performance of your investment portfolio with Sharesight. Sign up today so you can:

- Track all your investments in one place, including stocks in over 40 major global markets, mutual/managed funds, property, and even cryptocurrency

- Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

- Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation and future income (upcoming dividends)

- Easily share access to your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

Top trades by New Zealand Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for New Zealand investors, where we look at the top 20 trades made by New Zealand Sharesight users.

Top trades by global Sharesight users — January 2026

Welcome to the January 2026 edition of Sharesight’s trading snapshot for global investors, where we look at the top 20 trades made by Sharesight users globally.

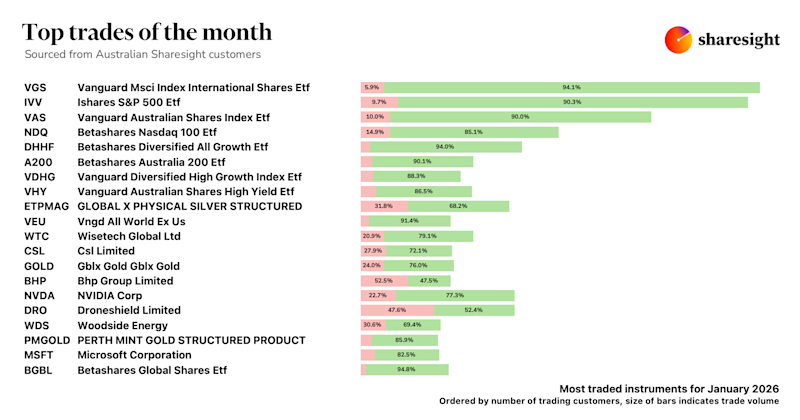

Top trades by Australian Sharesight users — January 2026

Welcome to the January 2026 edition of our trading snapshot for Australian investors, where we look at the top 20 trades made by Australian Sharesight users.