3 reasons why investors love Sharesight

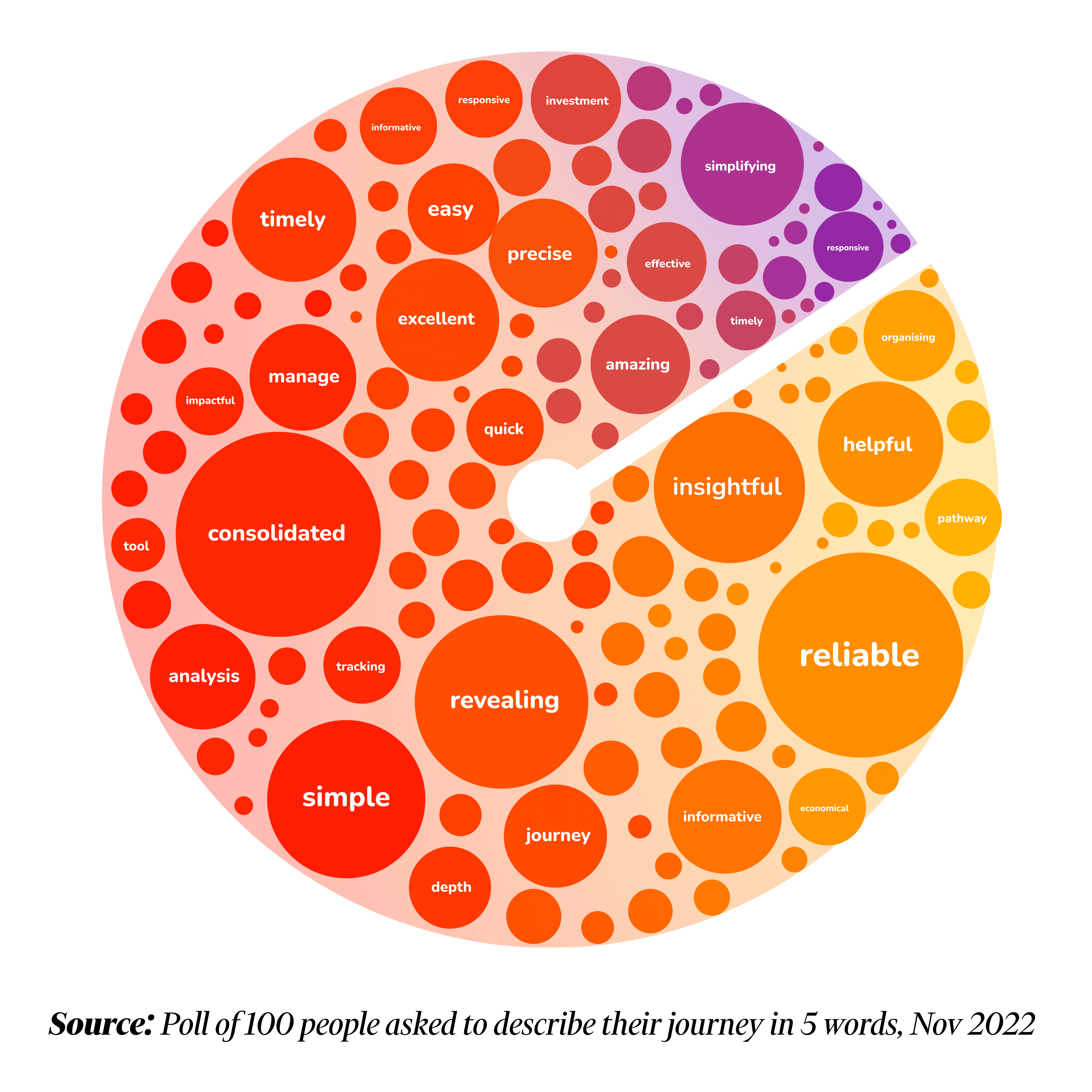

At Sharesight, we're always looking for ways to improve our customers' experiences. That's why we polled 100 of our users to hear firsthand what they think of our platform. The results were overwhelmingly positive, with many customers sharing similar sentiments about their experience. Some of the most common words to describe Sharesight were consolidated, insightful, revealing and reliable. In this blog, we're excited to share their feedback and provide some insight into why investors love using Sharesight.

We take pride in the fact that investors trust us to manage their portfolios, and we strive every day to exceed their expectations. Whether you're a seasoned investor or just starting out, we think you'll find something valuable in what our users had to say.

Consolidated

For many investors, one of the key benefits of using Sharesight is the ability to track all their investments in one place. Whether you are investing across different asset classes, markets, currencies or even brokers, Sharesight makes it easy to keep consolidated records of your trading data and tax information. Investors who want to see a broad picture of their performance can also take advantage of our consolidated view tool, which allows you to run reports and view the performance breakdown of your holdings across multiple (or all) your portfolios at once.

Sharesight’s portfolio tracker makes it easy to track the performance of all your investments in one place.

"Easy, consolidated, value for money." – Rajeev A.

"Finally can track all investments." – Anne S.

Insightful and revealing

Not only does Sharesight give you a consolidated view of your portfolio, but it also reveals the complete picture of your performance. What do we mean by this? Essentially, by keeping track of your investments through your broker(s), you are not getting the full picture of your performance. This is because most brokers only show you the difference between the buy and sell (or current) price of your shares, with an emphasis on daily price movements.

By comparison, Sharesight uses an annualised performance calculation methodology to show you your true performance, inclusive of capital gains, dividends, brokerage fees and foreign currency fluctuations. We also offer a range of advanced performance reports, giving you greater insight into your portfolio and the success of your investing strategy.

Designed to help investors evaluate their investing strategy, the contribution analysis report is part of Sharesight’s suite of advanced performance reports.

"Precise, profitable, versatile, revealing." – James B.

"A single pane of glass." – David B.

Reliable

Last but not least, it’s important to mention that investors have been relying on Sharesight to provide timely and accurate reporting for over 15 years now. During this time, we have continually expanded our product offering based on our customers’ feedback, and we have made it our mission to give investors the information they need to make informed investment decisions.

Not only this, but we have continued to expand our offering for global investors, with coverage for more than 40 major stock markets worldwide, plus the ability to automatically track trades from over 200 leading global brokers. The result is an industry-leading portfolio tracker that helps over 350,000 investors around the world.

"Excellent and reliable analysis tool, comprehensive coverage." – Mike P.

"Used daily for important decisions." – Geoffrey S.

Become a smarter investor with Sharesight

If you’re not already using Sharesight, what are you waiting for? Join hundreds of thousands of investors using Sharesight to track their portfolio and make smarter investment decisions. Sign up today so you can:

-

Track all your investments in one place, including stocks in over 40 major global markets, mutual/managed funds, property, and even cryptocurrency

-

Automatically track your dividend and distribution income from stocks, ETFs and mutual/managed funds

-

Run powerful reports built for investors, including performance, portfolio diversity, contribution analysis, multi-period, multi-currency valuation and future income (upcoming dividends)

-

Easily share access to your portfolio with family members, your accountant or other financial professionals so they can see the same picture of your investments as you do

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

FURTHER READING

Sharesight product updates – July 2025

This month's focus was on rolling out predictive income forecasting, as well as improved cash account syncing across different brokers and currencies.

5 ways Sharesight helps Australian investors at tax time

Learn how Sharesight’s Australian tax features can not only help you complete your tax return, but also save you time and money at tax time.

Sharesight users' top 20 trades – June 2025

Welcome to the June 2025 edition of Sharesight’s monthly trading snapshot, where we look at the top buy and sell trades by Sharesight users in all markets.