Track your RRSP and RRIF in Sharesight

Canadian investors can automatically track their Registered Retirement Savings Plan (RRSP) and Registered Retirement Income Fund (RRIF) accounts in Sharesight, inclusive of cash deposits and withdrawals, as well as investment income from stocks, ETFs and mutual funds. With specific tax settings built for Canadian investors, it’s never been easier for Canadian investors to track the performance of all their investments in one place. To learn how you can track your RRSP or RRIF in Sharesight, keep reading.

What is an RRSP?

A Registered Retirement Savings Plan (RRSP) is a tax-sheltered savings account that Canadians can contribute to throughout their career. Contributions to an RRSP can take the form of cash deposits (like a typical savings account) or investments in assets such as stocks, ETFs, mutual funds and many others. One of the benefits of having an RRSP is that the money contributed to the account can be deducted from your taxable income for that year, or deferred to a later year. Returns earned on any money invested (and returns earned) in an RRSP are also tax-free until the money is withdrawn from the account.

What is an RRIF?

A Registered Retirement Income Fund (RRIF) is a tax-sheltered savings account that Canadians can use to fund their retirement. It is often considered the natural continuation of an RRSP, in that the purpose of an RRSP is to accumulate money throughout your working life, while the purpose of an RRIF is to withdraw money in retirement. Because Canadians are not allowed to hold an RRSP after the end of the year they turn 71, many choose to convert their RRSP into an RRIF, although this is not a requirement. Similar to an RRSP, Canadians can choose to hold their funds in cash or various investment asset classes. RRIF account holders will also find that earnings within the account are tax-free until they are withdrawn.

How to track your RRSP or RRIF in Sharesight

To track an RRSP or RRIF in Sharesight, Canadian investors can simply set the tax entity of their portfolio to ‘RRSP’ or ‘RRIF’. This can be done by accessing the Settings, clicking ‘Tax settings’ and choosing the relevant tax entity type. By setting a Sharesight portfolio to ‘RRSP’ or ‘RRIF’, this means that non-resident withholding tax does not apply for US stocks in these portfolios.

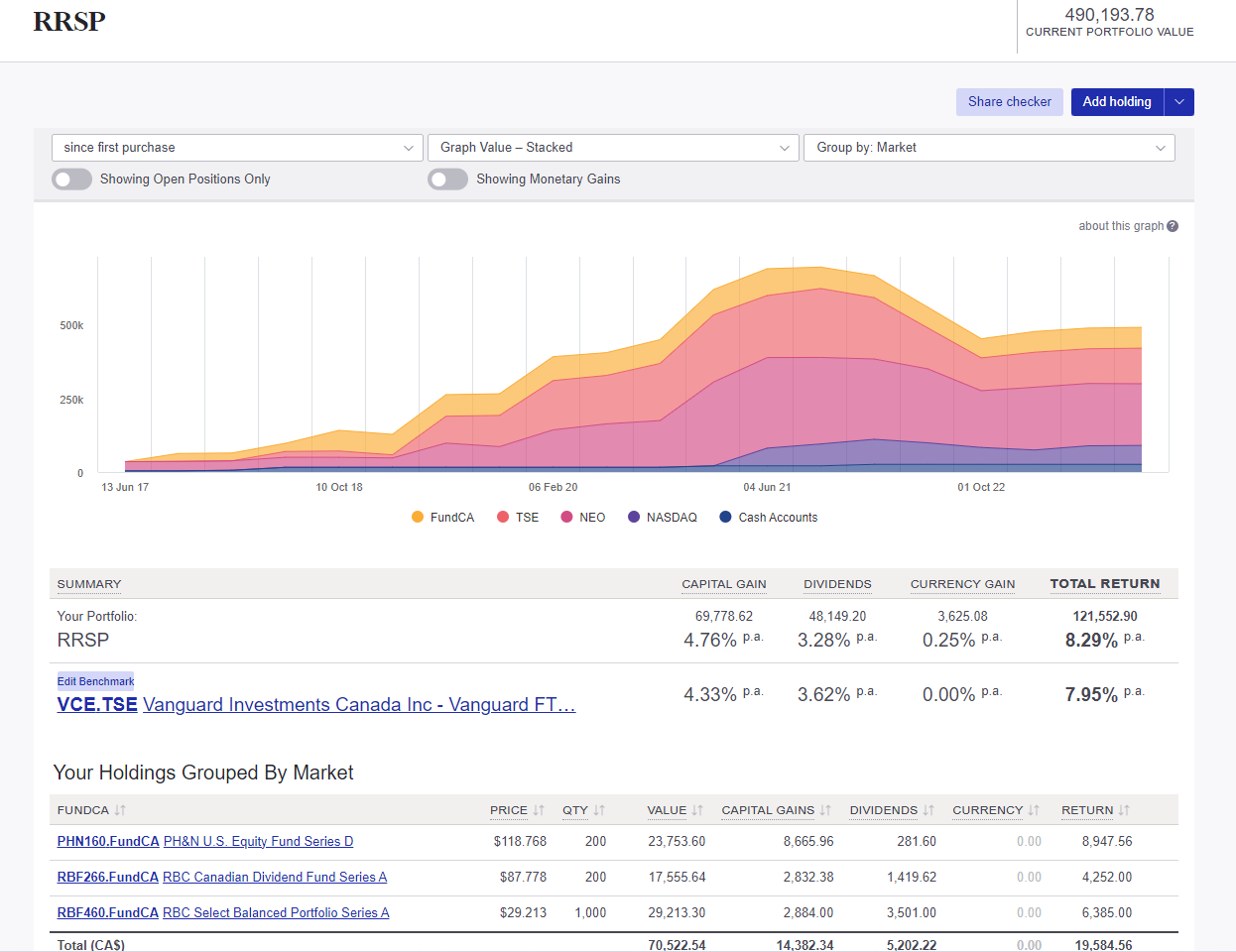

As can be seen in the screenshot below, an RRSP (for example) can be tracked in Sharesight just like any other portfolio type, with the ability to automatically track capital gains and dividends from investments, plus see the value of any deposits or withdrawals by tracking a cash account. Investors can also benchmark their RRSP/RRIF portfolio against any one of the 240,000+ global stocks, ETFs and funds that Sharesight tracks, which is a good way of understanding the portfolio’s performance in a broader market context.

An example of an RRSP being tracked in Sharesight. Investors can also track their RRIF, TFSA or other portfolio types.

Tax entities available for Canadian portfolios

| Tax entity type | Notes |

| Non-registered | Standard tax rules apply. |

| Registered Retirement Savings Plan (RRSP) | Non-resident withholding tax does not apply for US stocks. |

| Registered Retirement Income Fund (RRIF) | Non-resident withholding tax does not apply for US stocks. |

| Tax-Free Savings Account (TFSA) | Income from Canadian investments will be treated as non-taxable by default and not appear on the Taxable Income Report. Non-resident withholding tax still applies. |

Track your investment performance across all of your accounts

With Sharesight, not only can Canadian investors track the performance of all their RRSP, RRIF and TFSA investments, but they can also track the performance of all their different accounts in one place. This is made easy with Sharesight’s consolidated views feature, which allows investors to see performance across all their portfolios in a single view, including when running reports. For example, a Consolidated View could be useful for investors running the performance, diversity or contribution analysis reports, as it allows investors to view the asset allocation and top-performing investments across all their portfolios at a glance.

Start tracking your RRSP and RRIF with Sharesight

If you’re not already using Sharesight to track your RRSP or RRIF along with the rest of your investments, what are you waiting for? It’s free to sign up and with Sharesight you can:

-

Import historical trades from top Canadian brokers such as Questrade, Scotiabank, TD Direct, RBC Direct Investing and many more, including over 200 global brokers.

-

Track trades from over 40 global stock exchanges, including the Toronto Stock Exchange (TSE), CNSX (Canadian Securities Exchange) and Toronto TSX Ventures Exchange (CVE).

-

Track over 40,000 Canadian Mutual Funds, with more than 20 years of historical price and distribution data. Ongoing prices and distributions are automatically updated and editable at any time.

-

Track Canadian and foreign currencies, including cryptocurrencies.

-

Calculate your CGT with the canadian capital gains tax report.

Sign up for a FREE Sharesight account and get started tracking your investment performance (and tax) today.

![]()

Disclaimer: The above article is for informational purposes only and does not constitute a specific product recommendation, or taxation or financial advice and should not be relied upon as such. While we use reasonable endeavours to keep the information up-to-date, we make no representation that any information is accurate or up-to-date. If you choose to make use of the content in this article, you do so at your own risk. To the extent permitted by law, we do not assume any responsibility or liability arising from or connected with your use or reliance on the content on our site. Please check with your adviser or accountant to obtain the correct advice for your situation.

FURTHER READING

Sharesight nominated for 2025 Wealth Tech Innovator of the Year

Sharesight has been chosen as a finalist in the 2025 Australian Wealth Management Awards, in the Wealth Tech Innovator of the Year category.

Prepare your annual accounts with our historical cost report

Sharesight's historical cost report is a powerful tool for investors who need to prepare annual accounts or financial statements with mark-to-market accounting.

Sharesight product updates – July 2025

This month's focus was on rolling out predictive income forecasting, as well as improved cash account syncing across different brokers and currencies.