SMSF portfolio tracking software

Simplify your self managed super fund administration with an award-winning online SMSF portfolio tracker and reporting software built for Australian investors.

Sign up for free

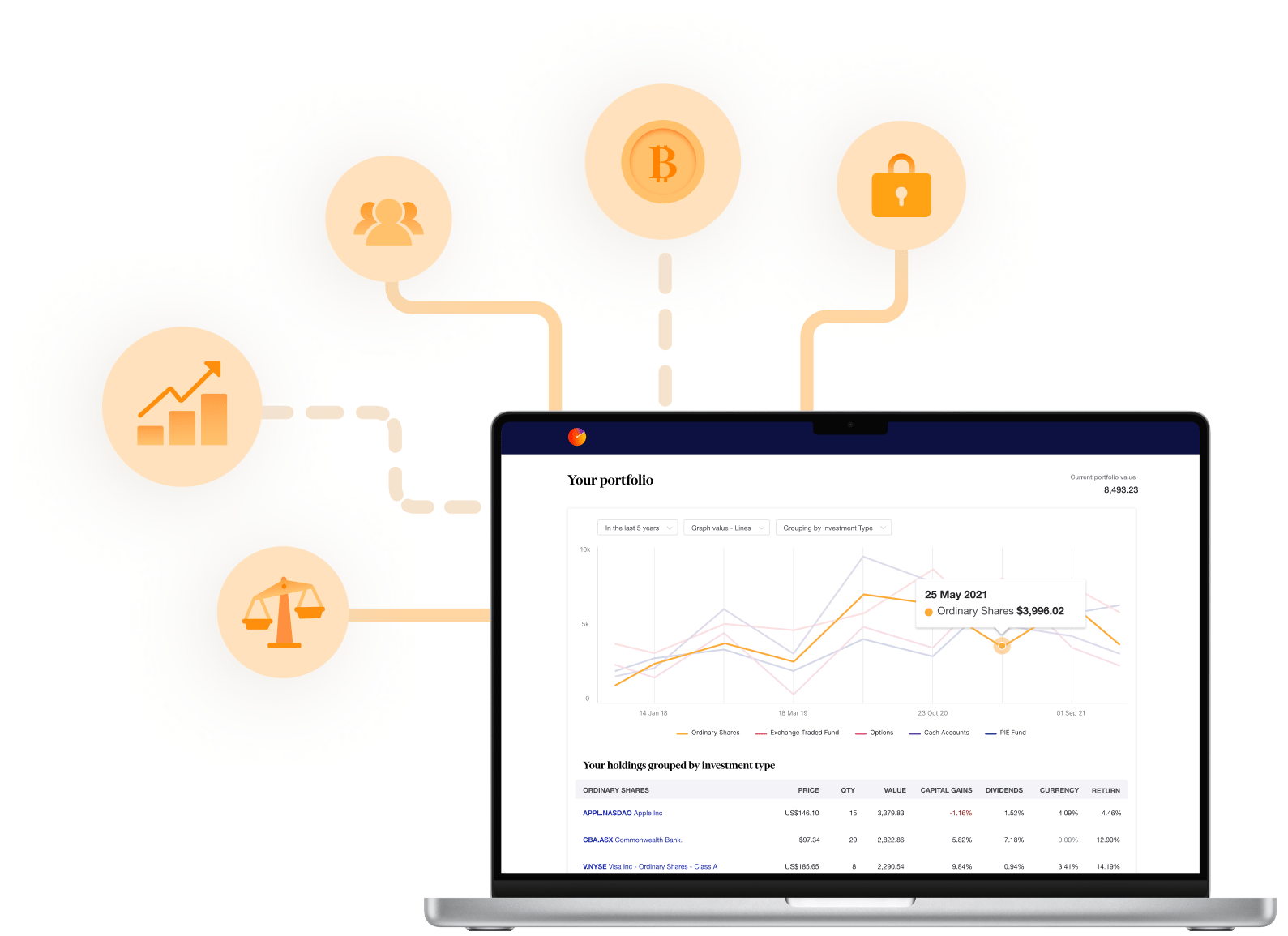

Track all your SMSF asset types

Track price and performance data on over 700,000 global shares, ETFs and managed funds, plus unlisted assets such as property.

More than just SMSF tracking

Track your performance and calculate tax implications across both your personal and SMSF investment portfolios.

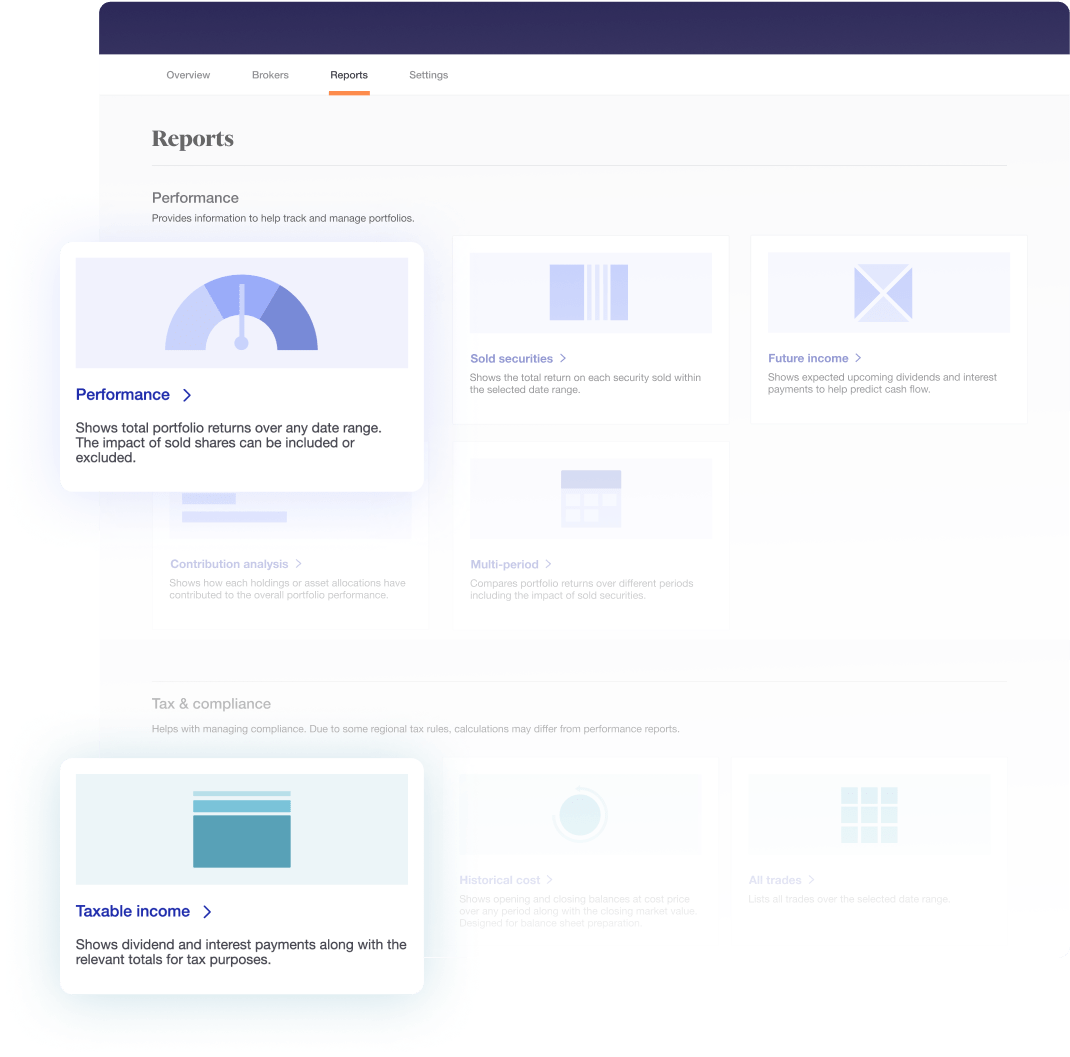

Run tax reports for SMSFs

Run reports built for SMSF trustees including asset allocation, investment income, franking credits, and capital gains tax.

“How I manage my SMSF with Sharesight”

Find out how self-directed investor Andrew Bird uses Sharesight to manage his SMSF.

Read the article

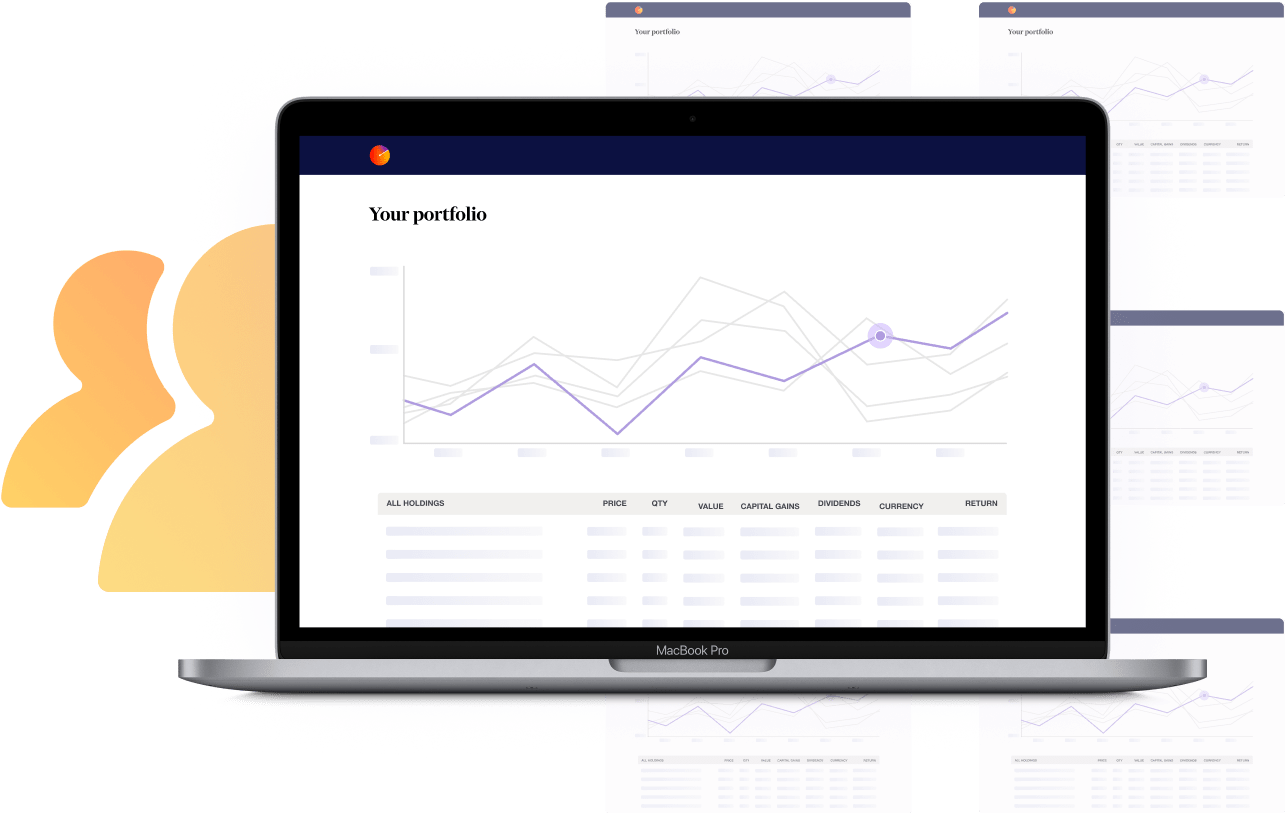

Everything you need to track your SMSF and personal investments

With Sharesight, all your investment data lives in one place. Track both your SMSF and personal investment portfolios and access powerful reports that make it easy to calculate both your investment performance and tax.

Understand your SMSF performance

Dive deeper into the performance of your SMSF asset allocation strategy using Sharesight’s Contribution Analysis Report, which shows you the contribution of each asset class to the overall performance of your portfolio.

Group the investments in your portfolio along the dimensions of your choice to compare performance across different countries, industries, sectors and more.

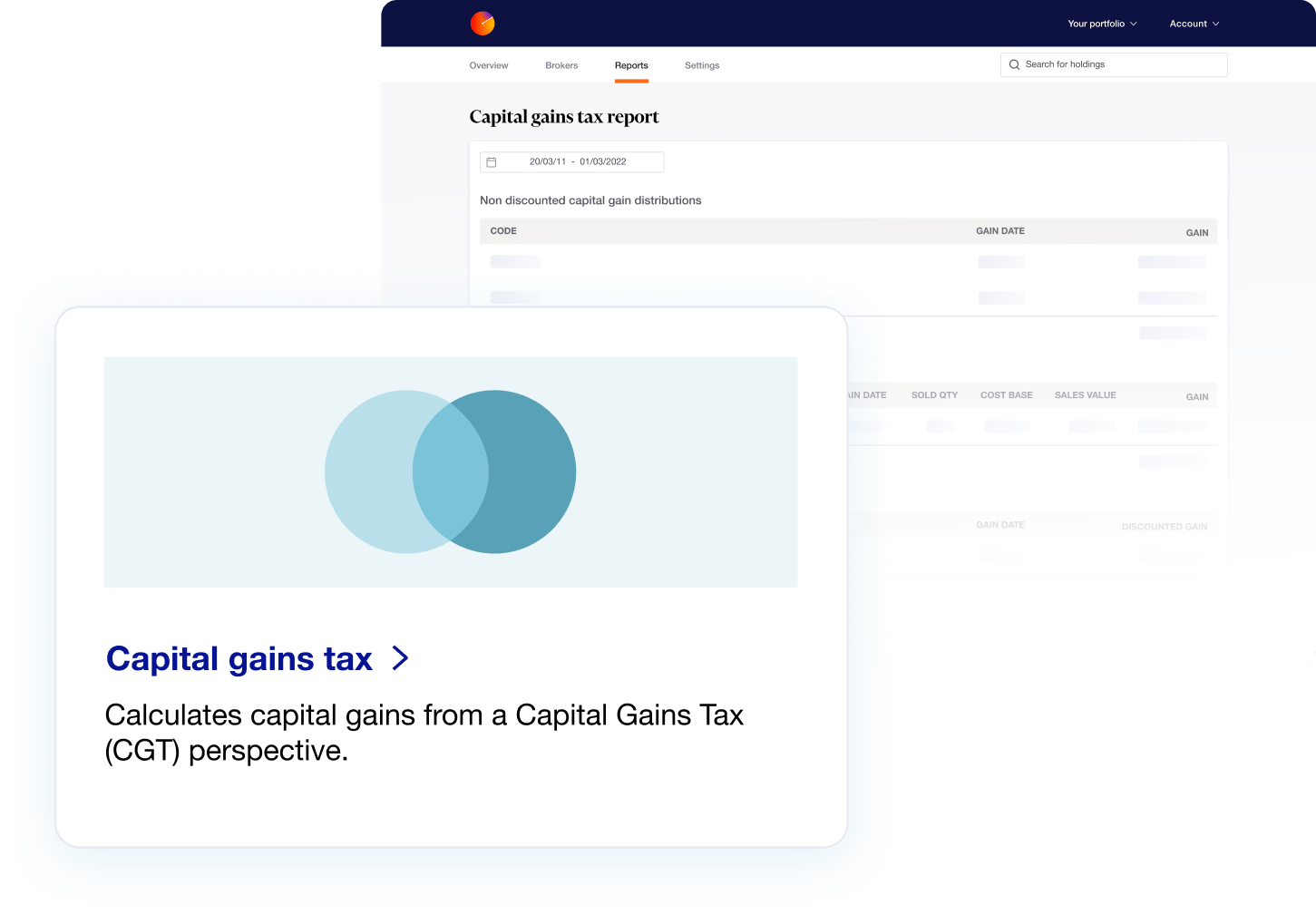

Calculate your capital gains tax

Calculate your capital gains on investments as per Australian Tax Office (ATO) rules with the Capital Gains Tax Report. You can also optimise your tax position by comparing sales allocation methods and parcel cost bases.

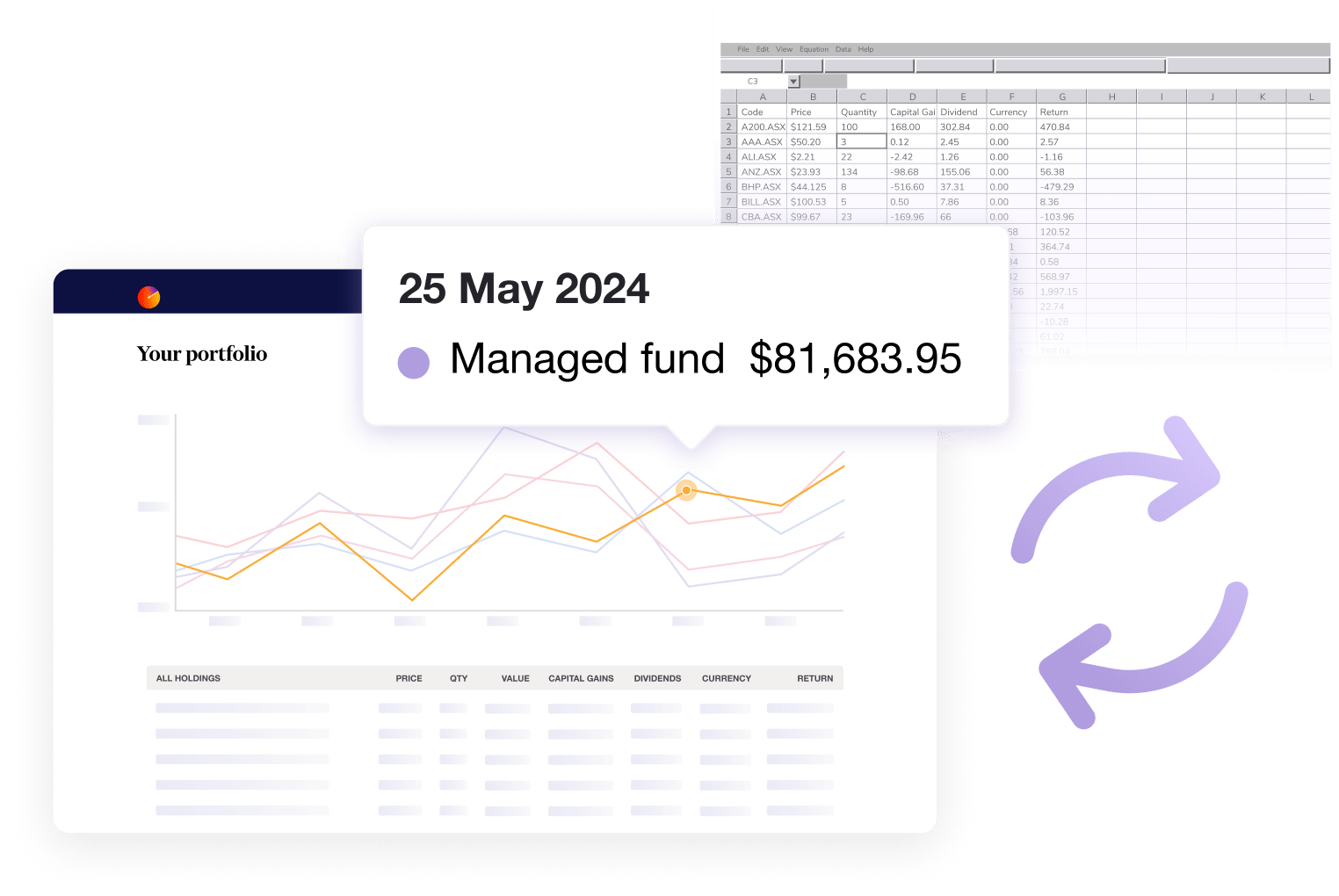

Swap your spreadsheet for Sharesight

Managing your SMSF portfolio used to involve manually updating a spreadsheet and hours spent with your accountant. Online SMSF portfolio management tools like Sharesight make it easy.

Built for Australian investors

Investors just like you use Sharesight to get all the info they need to report investment income as part of their tax returns with the ATO.

Australian tax rules

CGT discounts are automatically calculated based on your tax entity: Individual/Trust, SMSF or Company.

Franking credits

See all your dividends automatically tracked, with a breakdown of franked and unfranked dividend income.

SMSF record-keeping

Automatically record all trades & dividends, and connect to Xero to reconcile with your bank account.

How one couple saves time and money using Sharesight

Over time Nick and Katie’s spreadsheets became increasingly difficult to maintain, and they realised it had become untenable to keep going this way.

How SMSF trustees can get EOFY-ready

Keep reading to learn more about how Sharesight saves SMSF trustees time and money at tax time, and how trustees can get EOFY-ready with Sharesight.

The importance of asset allocation tracking for SMSFs

Like all investments, it’s critical to track the performance of and distributions earned by exchange-traded funds (ETFs) in your portfolio.

Are you an accountant?

Sharesight’s professional SMSF accounting software is the perfect fit for you and your clients. Find out more about the professional offering on our accountants page.

500

k+

700

k+

200

Plans & Pricing

Start by tracking up to 10 holdings for free! Then upgrade to a premium plan at any time to track additional holdings or portfolios, and unlock advanced features. And as a bonus, your Sharesight subscription may be tax deductible. *

Free

$0

Forever

Starter

$19

AUD per month

billed annually

$25.33 AUD billed monthly

Investor

$29

AUD per month

billed annually

$38.67 AUD billed monthly

Expert

$49

AUD per month

billed annually

$65.33 AUD billed monthly

Don't just take our word for it

Over 500,000+ investors track their investments with Sharesight. Here’s what a few of them have to say:

SMSF Portfolio Tracker FAQs

How to track net wealth position and investment performance across SMSF and personal portfolios?

With Sharesight, you can track everything from stocks and ETFs to managed funds, brokerage cash accounts, property and cryptocurrency – all in one place. This means you can clearly see the full picture of your performance (and your net wealth). Simply separate your personal investments and SMSF investments into different portfolios, making it easier to track the performance of your portfolios individually (as well as the tax implications). It’s also easy to see your wealth and performance across multiple Sharesight portfolios by creating a Consolidated View, which amalgamates the stocks, ETFs and funds across all of your portfolios into one “view”, which you can access in your Portfolio Overview page, as well as throughout the majority of Sharesight reports.