Latest posts

Track your brokerage cash account alongside your investments

Track your brokerage cash account within your investment portfolio using Sharesight to see the full picture of your investment performance.

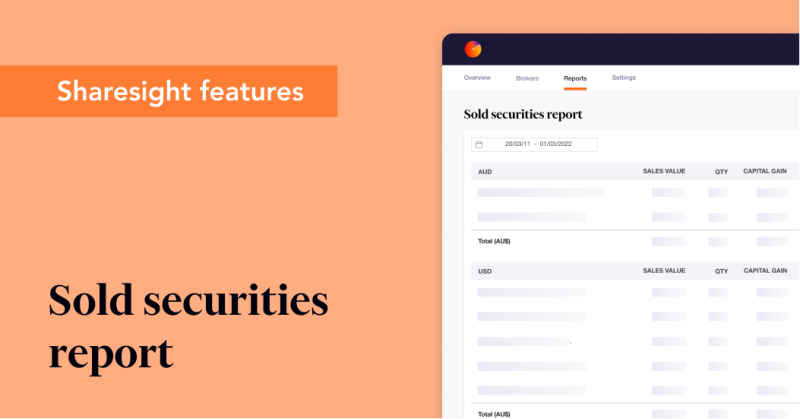

3 ways Sharesight helps investors at tax time

Whether you file your own tax return, or work with an accountant, Sharesight can save you both time and money at tax time.

Track stocks on the KOSDAQ exchange with Sharesight

With Sharesight, investors can easily track more than 1,400 stocks and ETFs on the KOSDAQ exchange, with daily price and performance updates.

Get a fresh view on your investments in 2022

We share three tips and tricks to get increased visibility into your portfolio’s returns while also saving time and money managing your investments.

Get Small Caps news in Sharesight

With Sharesight, investors can get Small Caps news directly in their portfolio for ASX-listed stocks. Keep reading to learn more.

Track stocks on the Tel Aviv Stock Exchange with Sharesight

With Sharesight, investors can easily track over 1,000 stocks and ETFs on the Tel Aviv Stock Exchange (TASE), plus over 40 leading global markets.

How to calculate cost base per share

To learn more about cost base per share, how it’s calculated and how you can automatically track it using Sharesight, keep reading.

Sharesies investors can sync their trades directly to Sharesight

Investors who use the Sharesies platform can automatically sync trades to their Sharesight portfolio and access award-winning performance and tax reporting.

Track over 12,000 AU/NZ managed funds with Sharesight

With Sharesight, investors can track the price and performance of over 12,000 Australian managed funds and mFunds, plus more than 700 New Zealand funds.

Diversiview by LENSELL integrates with Sharesight

Diversiview by LENSELL has integrated with Sharesight, allowing investors to analyse their portfolios' health, diversification and risk & return positions.

Easily prepare SoAs by connecting Sharesight and ProductRex

ProductRex has integrated with the Sharesight API, creating a solution that helps financial advisers make better decisions for their clients.

Get Firstlinks insights within Sharesight

We've partnered with Firstlinks (formerly Cuffelinks) to bring you the latest ASX investing insights directly into your Sharesight portfolio.